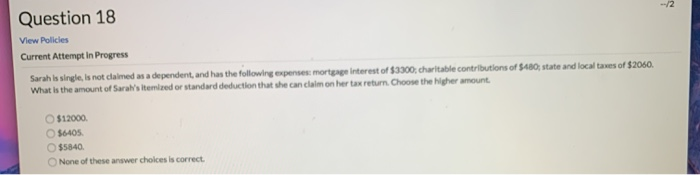

Question: Question 18 View Policies Current Attempt In Progress Sarah Is single, is not claimed as a dependent, and has the following expenses mortgage Interest of

Question 18 View Policies Current Attempt In Progress Sarah Is single, is not claimed as a dependent, and has the following expenses mortgage Interest of $3300, charitable contributions of $480, state and local taxes of $2060. What is the amount of Sarah's itemized or standard deduction that she can claim on her tax return. Choose the higher amount O $12000 $6405 $5840 None of these answer choices is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts