Question: QUESTION 18 Which covenant is designed to protect against structural subordination? Subsidiary debt covenant Liens covenant Restricted payments covenant Mergers covenant QUESTION 19 If you

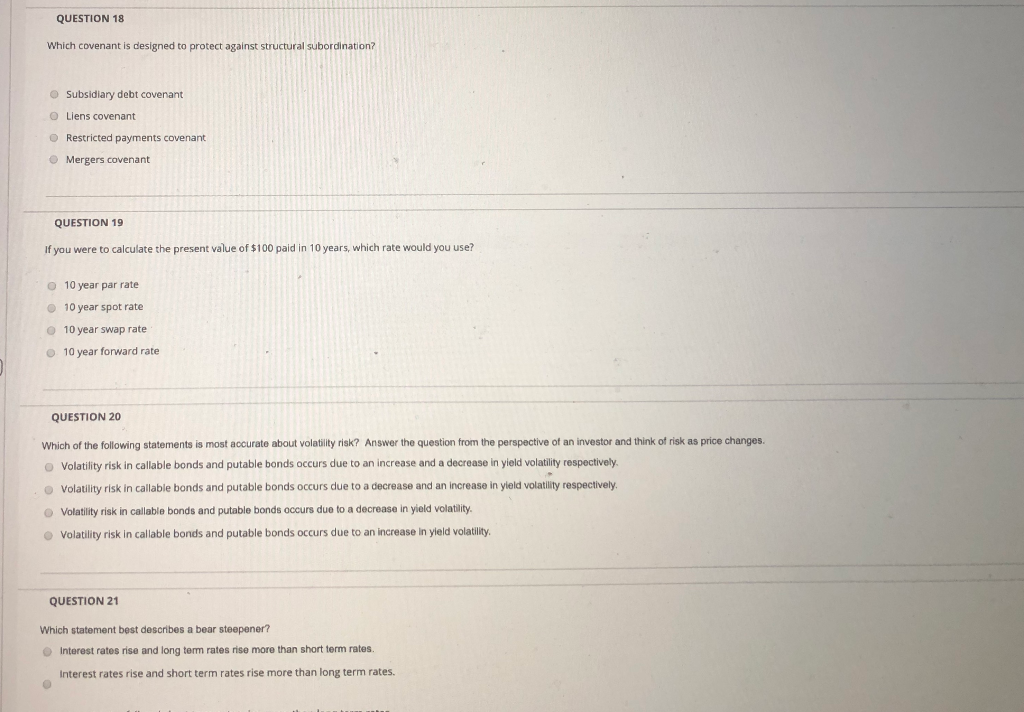

QUESTION 18 Which covenant is designed to protect against structural subordination? Subsidiary debt covenant Liens covenant Restricted payments covenant Mergers covenant QUESTION 19 If you were to calculate the present value of $100 paid in 10 years, which rate would you use? 10 year par rate 10 year spot rate 10 year swap rate 10 year forward rate QUESTION 20 Which of the following statements is most accurate about volatility risk? Answer the question from the perspective of an investor and think of risk as price changes. Volatility risk in callable bonds and putable bonds occurs due to an increase and a decrease in yield volatility respectively, Volatility risk in cailable bonds and putable bonds occurs due to a decrease and an increase in yield volatility respectively. Volatility risk in cailable bonds and putable bonds occurs due to a decrease in yield volatility. Volatility risk in callable bonds and putable bonds occurs due to an increase in yield volatility QUESTION 21 Which statement best describes a bear steepener? Interest rates rise and long term rates rise more than short term rates Interest rates rise and short term rates rise more than long term rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts