Question: Question 19 (1 point) Using the information in the previous question to compute the NPV of the project for Datta Computer Systems given the firm's

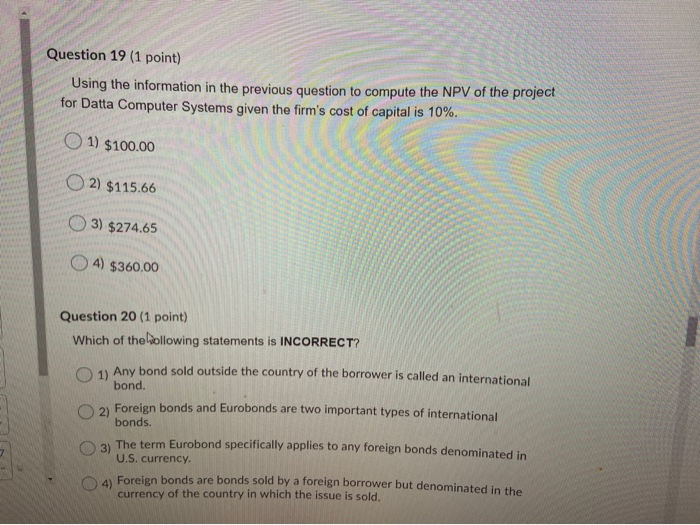

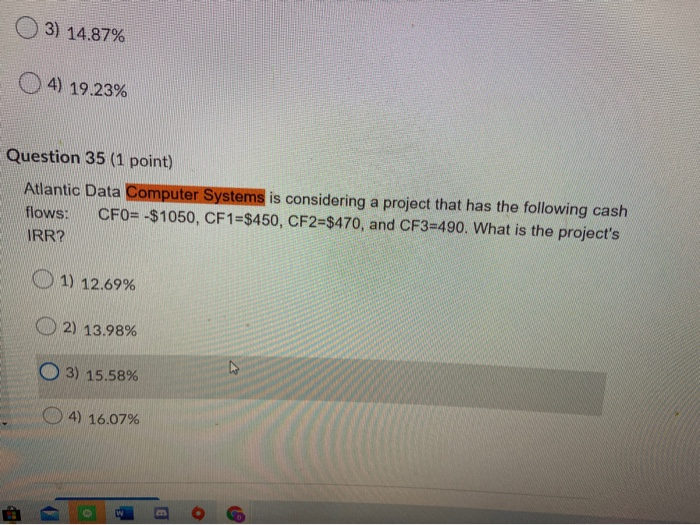

Question 19 (1 point) Using the information in the previous question to compute the NPV of the project for Datta Computer Systems given the firm's cost of capital is 10%. 1) $100.00 2) $115.66 3) $274.65 4) $360,00 Question 20 (1 point) Which of the vollowing statements is INCORRECT? 1) Any bond sold outside the country of the borrower is called an international bond. 2) Foreign bonds and Eurobonds are two important types of international bonds. 3) The term Eurobond specifically applies to any foreign bonds denominated in U.S. currency. Foreign bonds are bonds sold by a foreign borrower but denominated in the currency of the country in which the issue is sold. 3) 14.87% O 4) 19.23% Question 35 (1 point) Atlantic Data Computer Systems is considering a project that has the following cash flows: CF0= -$1050, CF 1=$450, CF2=$470, and CF3=490. What is the project's IRR? 1) 12.69% 2) 13.98% O 3) 15.58% 4) 16.07% Question 19 (1 point) Using the information in the previous question to compute the NPV of the project for Datta Computer Systems given the firm's cost of capital is 10%. 1) $100.00 2) $115.66 3) $274.65 4) $360,00 Question 20 (1 point) Which of the vollowing statements is INCORRECT? 1) Any bond sold outside the country of the borrower is called an international bond. 2) Foreign bonds and Eurobonds are two important types of international bonds. 3) The term Eurobond specifically applies to any foreign bonds denominated in U.S. currency. Foreign bonds are bonds sold by a foreign borrower but denominated in the currency of the country in which the issue is sold. 3) 14.87% O 4) 19.23% Question 35 (1 point) Atlantic Data Computer Systems is considering a project that has the following cash flows: CF0= -$1050, CF 1=$450, CF2=$470, and CF3=490. What is the project's IRR? 1) 12.69% 2) 13.98% O 3) 15.58% 4) 16.07%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts