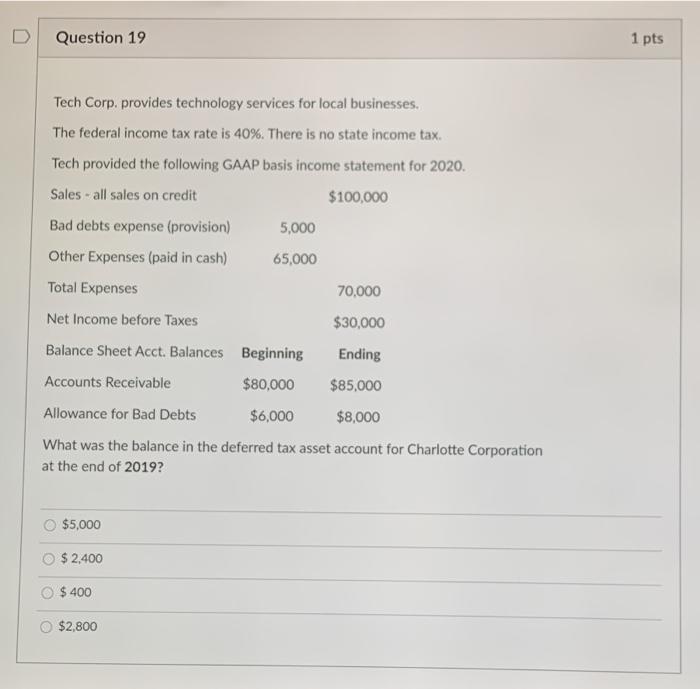

Question: Question 19 1 pts Tech Corp. provides technology services for local businesses. The federal income tax rate is 40%. There is no state income tax.

Question 19 1 pts Tech Corp. provides technology services for local businesses. The federal income tax rate is 40%. There is no state income tax. Tech provided the following GAAP basis income statement for 2020. Sales - all sales on credit $100,000 Bad debts expense (provision) 5,000 Other Expenses (paid in cash) 65,000 Total Expenses 70,000 Net Income before Taxes $30,000 Balance Sheet Acct. Balances Beginning Ending Accounts Receivable $80,000 $85,000 Allowance for Bad Debts $6,000 $8,000 What was the balance in the deferred tax asset account for Charlotte Corporation at the end of 2019? $5,000 $ 2,400 $ 400 $2,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts