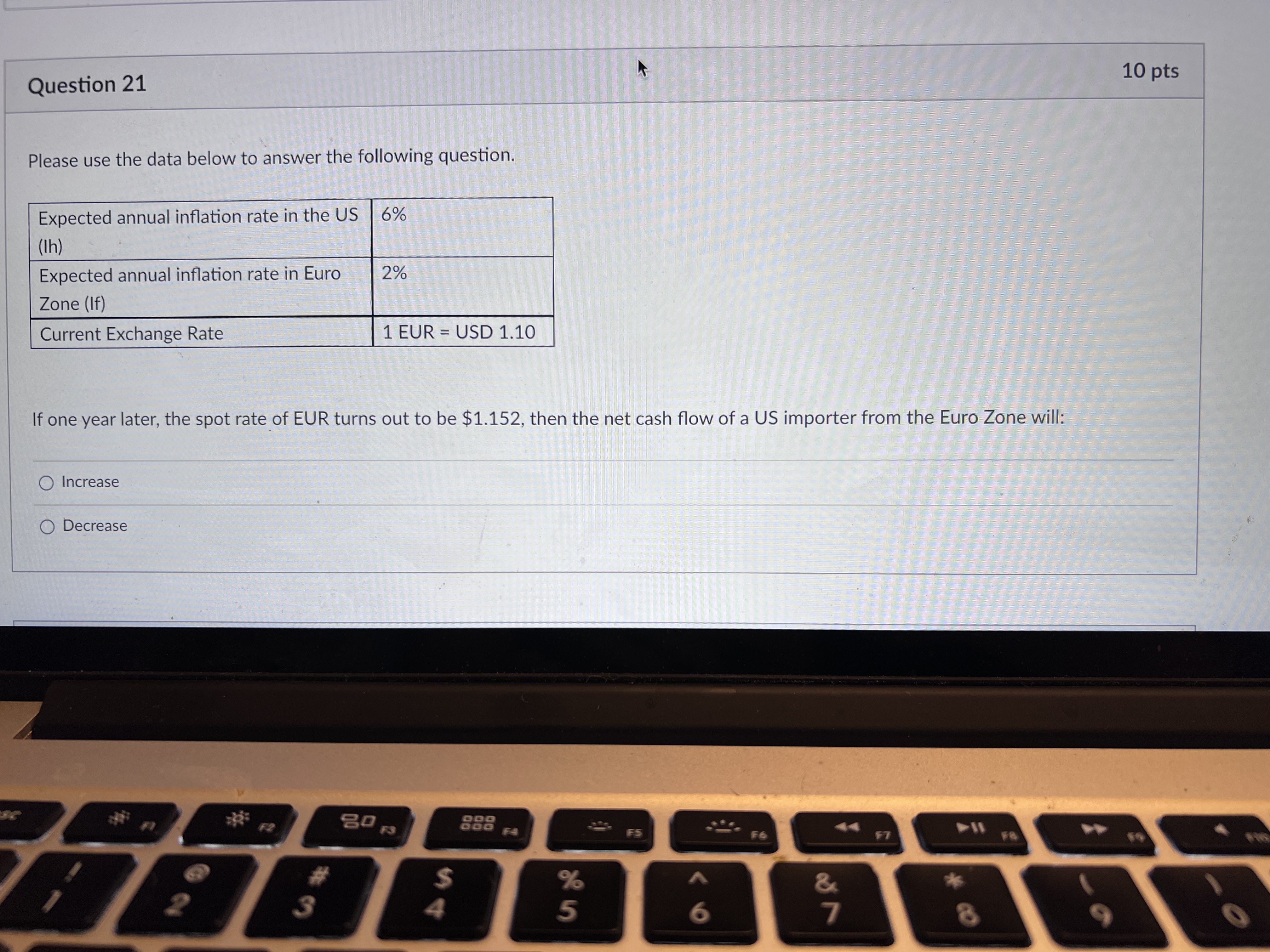

Question: Question 19 10 pts Please use the data below to answer the following question. Expected annual inflation rate in the US |6% (Ih) Expected annual

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock