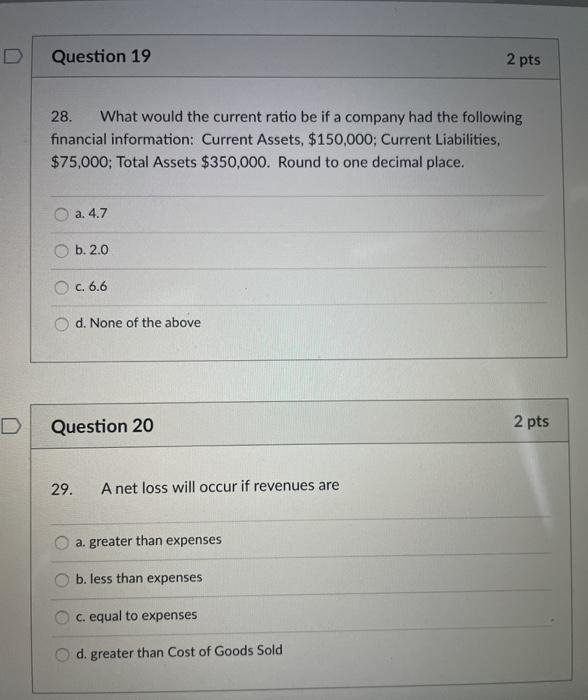

Question: Question 19 2 pts 28. What would the current ratio be if a company had the following financial information: Current Assets, $150,000; Current Liabilities, $75,000;

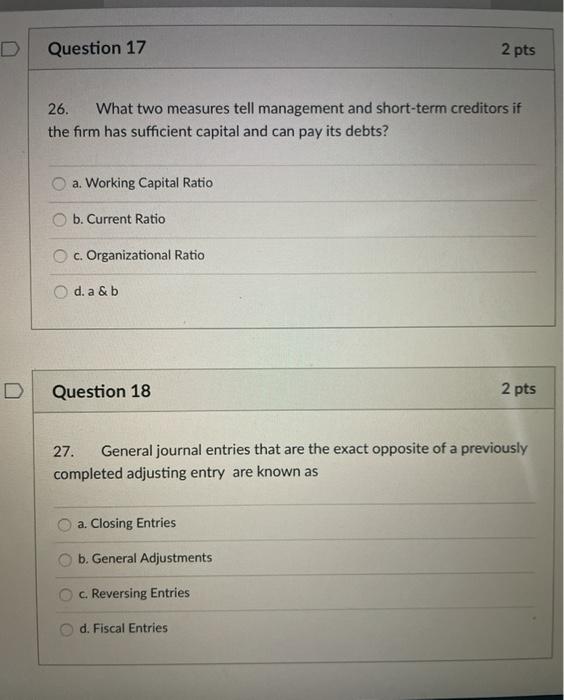

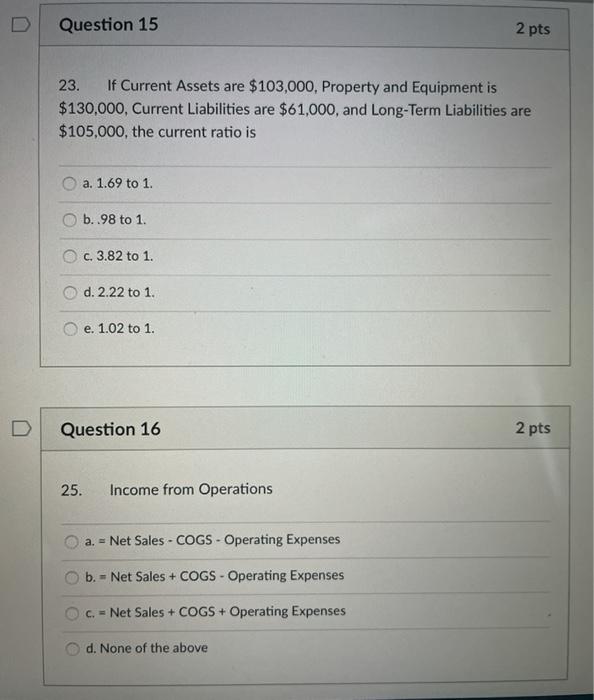

Question 19 2 pts 28. What would the current ratio be if a company had the following financial information: Current Assets, $150,000; Current Liabilities, $75,000; Total Assets $350,000. Round to one decimal place. a. 4.7 O b. 2.0 C. 6.6 O d. None of the above Question 20 2 pts 29. A net loss will occur if revenues are a greater than expenses b. less than expenses c. equal to expenses d. greater than Cost of Goods Sold Question 17 2 pts 26. What two measures tell management and short-term creditors if the firm has sufficient capital and can pay its debts? a. Working Capital Ratio O b. Current Ratio c. Organizational Ratio d. a & b Question 18 2 pts 27. General journal entries that are the exact opposite of a previously completed adjusting entry are known as a. Closing Entries b. General Adjustments c. Reversing Entries d. Fiscal Entries Question 15 2 pts 23. If Current Assets are $103,000, Property and Equipment is $130,000. Current Liabilities are $61,000, and Long-Term Liabilities are $105,000, the current ratio is a. 1.69 to 1. b. 98 to 1. c. 3.82 to 1. d. 2.22 to 1. e. 1.02 to 1. Question 16 2 pts 25. Income from Operations a. = Net Sales - COGS - Operating Expenses b. - Net Sales + COGS - Operating Expenses c. = Net Sales + COGS + Operating Expenses d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts