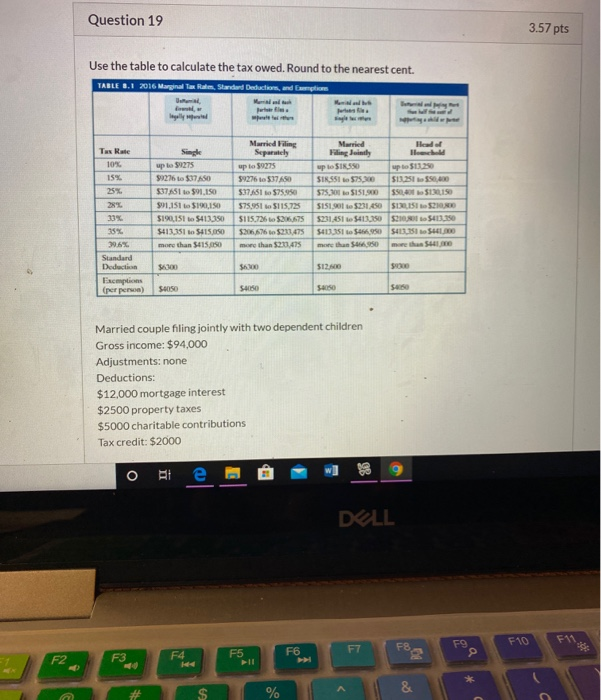

Question: Question 19 3.57 pts Use the table to calculate the tax owed. Round to the nearest cent. TABLE 8.1 2016 Marginal Tax Ralm, Standard Deduction,

Question 19 3.57 pts Use the table to calculate the tax owed. Round to the nearest cent. TABLE 8.1 2016 Marginal Tax Ralm, Standard Deduction, and more lagellyel agle Tw Rate 10% 15% 25% Single up to 2275 99276 to 537A50 537A516 591.150 $91,151 to $190,150 $190.151 to 5413,350 5413,351 to 415.00 more than $415.450 Married Filing Separately up to $9275 9927637 ASO 537451 to 575950 575,951 65115.725 $115.726 to $226,675 $206,765211 475 more than $201.415 Married Head of Filing July H up SIRSSO up to 20 SIR 551 575,300 $13,251 to 50,400 575,301 5151.500 $50,0 13,150 SISI SOT 5231450 120 5231,451 4132150 2105403_150 541333510 541_151 SHL more than 90 more than 33% 35% 39.6% Standard Deduction (per person) $6.00 $12.00 SAS $4050 54050 Married couple filing jointly with two dependent children Gross income: $94,000 Adjustments: none Deductions: $12,000 mortgage interest $2500 property taxes $5000 charitable contributions Tax credit: $2000 O e DELL F10 F11 F9 F7 F8 F6 F5 F4 F2 F3 $ & %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts