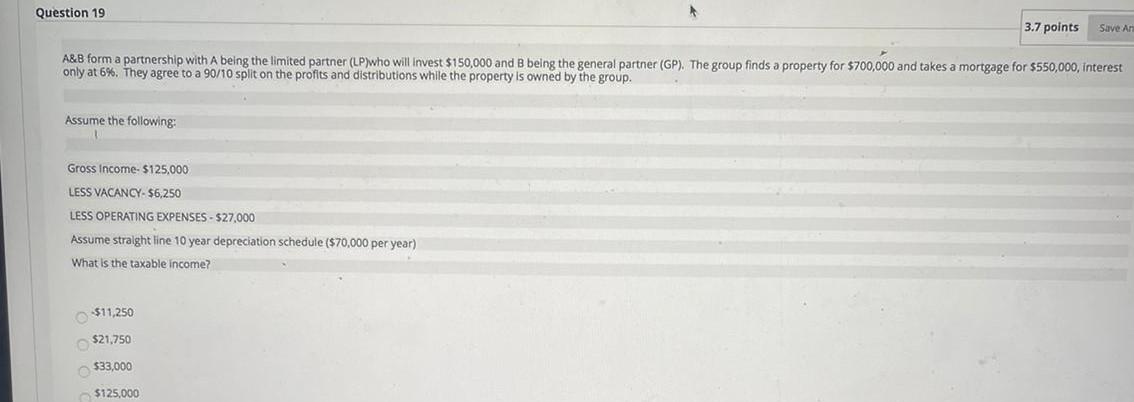

Question: Question 19 3.7 points Save An A&B form a partnership with A being the limited partner (LP)who will invest $150,000 and B being the general

Question 19 3.7 points Save An A&B form a partnership with A being the limited partner (LP)who will invest $150,000 and B being the general partner (GP). The group finds a property for $700,000 and takes a mortgage for $550,000, interest only at 6%. They agree to a 90/10 split on the profits and distributions while the property is owned by the group. Assume the following: Gross income-5125.000 LESS VACANCY: $6,250 LESS OPERATING EXPENSES - $27,000 Assume straight line 10 year depreciation schedule ($70,000 per year) What is the taxable income? $11,250 $21,750 $33,000 $125,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts