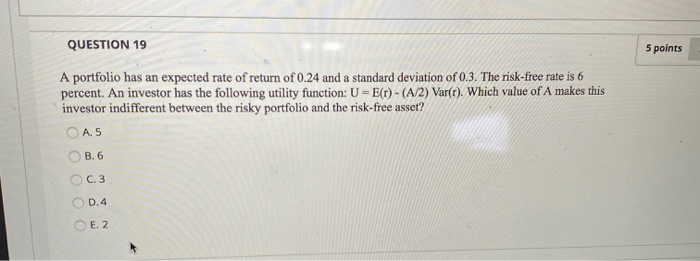

Question: QUESTION 19 5 points A portfolio has an expected rate of return of 0.24 and a standard deviation of 0.3. The risk-free rate is 6

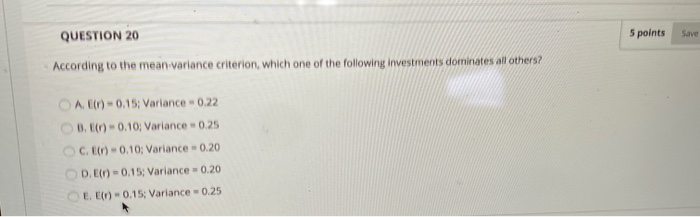

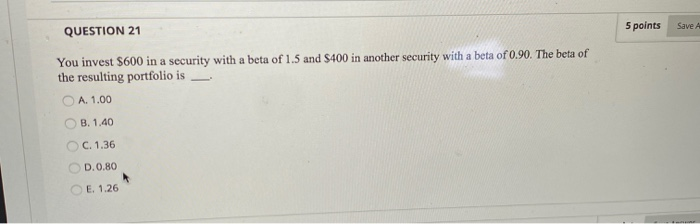

QUESTION 19 5 points A portfolio has an expected rate of return of 0.24 and a standard deviation of 0.3. The risk-free rate is 6 percent. An investor has the following utility function: U=E(r) - (A/2) Var(t). Which value of A makes this investor indifferent between the risky portfolio and the risk-free asset? O A.5 OB.6 6.3 0.4 O E.2 QUESTION 20 5 points Save According to the mean variance criterion, which one of the following investments dominates all others? A E 0.15; Variance - 0.22 0.6 - 0.10; Variance - 0.25 CE) - 0.10; Variance - 0.20 DEO) -0.15; Variance - 0.20 L. ) -0.15: Variance - 0.25 QUESTION 21 5 points Save You invest $600 in a security with a beta of 1.5 and $400 in another security with a beta of 0.90. The beta of the resulting portfolio is A. 1.00 B. 1.40 C. 1.36 D.0.80 E. 1.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts