Question: Question 19 5 pts Jill would like to plan for her son's college education. She would like for her son, who was born today, to

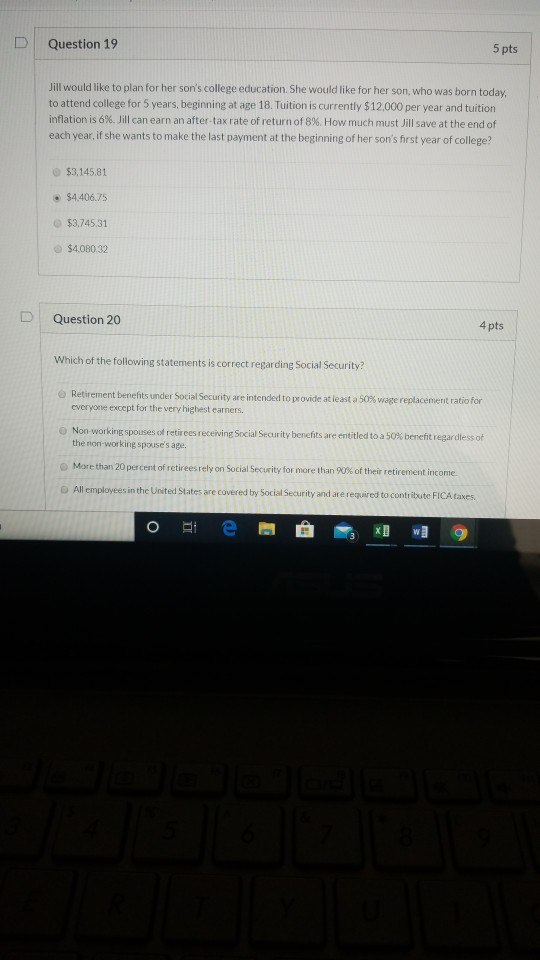

Question 19 5 pts Jill would like to plan for her son's college education. She would like for her son, who was born today, to attend college for 5 years, beginning at age 18. Tuition is currently $12,000 per year and tuition inflation is 6%. Jill can earn an after-tax rate of return of 8%. How much must Jill save at the end of each year, if she wants to make the last payment at the beginning of her son's first year of college? $3.145.81 $4.406,75 $3,745 31 $4.080.32 Question 20 4 pts Which of the following statements is correct regarding Social Security? Retirement benefits under Social Security are intended to provide at least a 50% wage replacement ratio for everyone except for the very highest earners, Non working spouses of retirees receiving Social Security benefits are entitled to a 50% benefit regardless of the non-working spouse's age. More than 20 percent of retirees rely on Social Security for more than 90% of their retirement income All employees in the United States are covered by Social Security and are required to contribute FICA taxes. o Ri Question 19 5 pts Jill would like to plan for her son's college education. She would like for her son, who was born today, to attend college for 5 years, beginning at age 18. Tuition is currently $12,000 per year and tuition inflation is 6%. Jill can earn an after-tax rate of return of 8%. How much must Jill save at the end of each year, if she wants to make the last payment at the beginning of her son's first year of college? $3.145.81 $4.406,75 $3,745 31 $4.080.32 Question 20 4 pts Which of the following statements is correct regarding Social Security? Retirement benefits under Social Security are intended to provide at least a 50% wage replacement ratio for everyone except for the very highest earners, Non working spouses of retirees receiving Social Security benefits are entitled to a 50% benefit regardless of the non-working spouse's age. More than 20 percent of retirees rely on Social Security for more than 90% of their retirement income All employees in the United States are covered by Social Security and are required to contribute FICA taxes. o Ri

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts