Question: QUESTION 19 8 points View Rubric Save Answer Problem 5: Cost of Capital (pts). Wyatt Oil is an energy company whose capital structure is made

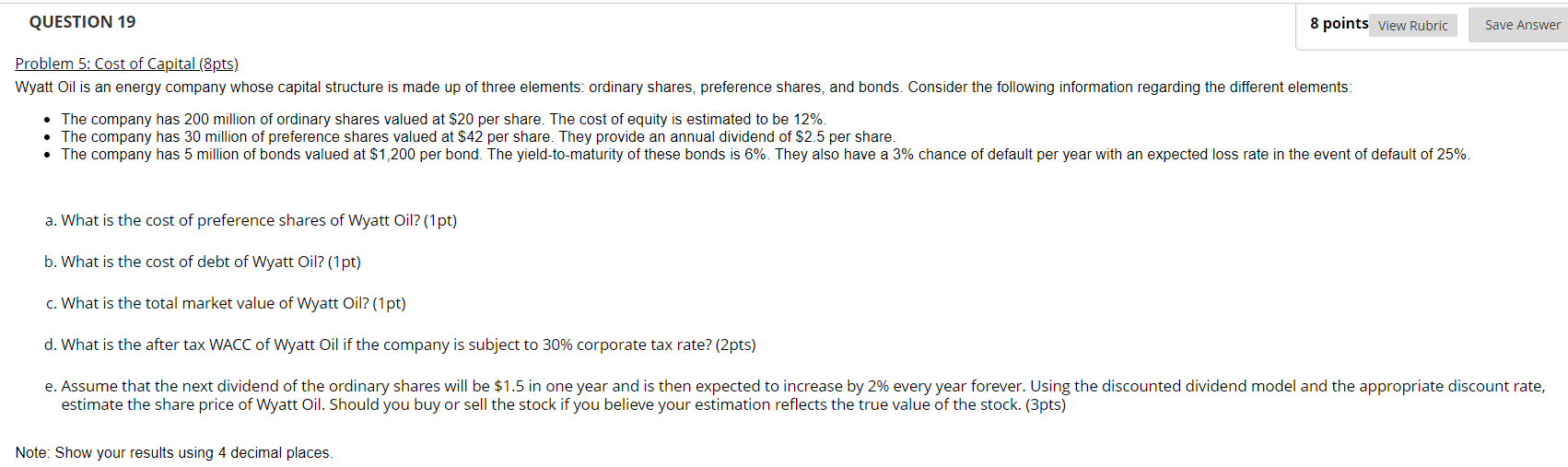

QUESTION 19 8 points View Rubric Save Answer Problem 5: Cost of Capital (pts). Wyatt Oil is an energy company whose capital structure is made up of three elements: ordinary shares, preference shares, and bonds. Consider the following information regarding the different elements: The company has 200 million of ordinary shares valued at $20 per share. The cost of equity is estimated to be 12%. The company has 30 million of preference shares valued at $42 per share. They provide an annual dividend of $2.5 per share. The company has 5 million of bonds valued at $1,200 per bond. The yield-to-maturity of these bonds is 6%. They also have a 3% chance of default per year with an expected loss rate in the event of default of 25%. a. What is the cost of preference shares of Wyatt Oil? (1pt) b. What is the cost of debt of Wyatt Oil? (1 pt) c. What is the total market value of Wyatt Oil? (1 pt) d. What is the after tax WACC of Wyatt Oil if the company is subject to 30% corporate tax rate? (2pts) e. Assume that the next dividend of the ordinary shares will be $1.5 in one year and is then expected to increase by 2% every year forever. Using the discounted dividend model and the appropriate discount rate, estimate the share price of Wyatt Oil. Should you buy or sell the stock if you believe your estimation reflects the true value of the stock. (3pts) Note: Show your results using 4 decimal places. QUESTION 19 8 points View Rubric Save Answer Problem 5: Cost of Capital (pts). Wyatt Oil is an energy company whose capital structure is made up of three elements: ordinary shares, preference shares, and bonds. Consider the following information regarding the different elements: The company has 200 million of ordinary shares valued at $20 per share. The cost of equity is estimated to be 12%. The company has 30 million of preference shares valued at $42 per share. They provide an annual dividend of $2.5 per share. The company has 5 million of bonds valued at $1,200 per bond. The yield-to-maturity of these bonds is 6%. They also have a 3% chance of default per year with an expected loss rate in the event of default of 25%. a. What is the cost of preference shares of Wyatt Oil? (1pt) b. What is the cost of debt of Wyatt Oil? (1 pt) c. What is the total market value of Wyatt Oil? (1 pt) d. What is the after tax WACC of Wyatt Oil if the company is subject to 30% corporate tax rate? (2pts) e. Assume that the next dividend of the ordinary shares will be $1.5 in one year and is then expected to increase by 2% every year forever. Using the discounted dividend model and the appropriate discount rate, estimate the share price of Wyatt Oil. Should you buy or sell the stock if you believe your estimation reflects the true value of the stock. (3pts) Note: Show your results using 4 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts