Question: Question 19 (9 points) On Jul 31, HRM Ltd had a cash balance of $10559 in the general ledger. The bank statement on that date

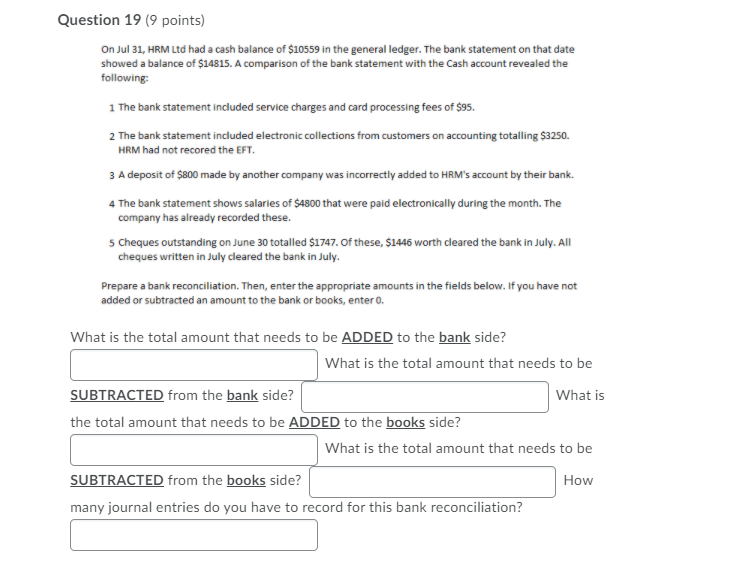

Question 19 (9 points) On Jul 31, HRM Ltd had a cash balance of $10559 in the general ledger. The bank statement on that date showed a balance of $14815. A comparison of the bank statement with the Cash account revealed the following: 1 The bank statement included service charges and card processing fees of $95. 2 The bank statement included electronic collections from customers on accounting totalling $3250. HRM had not recored the EFT. 3 A deposit of $800 made by another company was incorrectly added to HRM's account by their bank. 4 The bank statement shows salaries of $4800 that were paid electronically during the month. The company has already recorded these. 5 Cheques outstanding on June 30 totalled $1747. Of these, $1446 worth cleared the bank in July. All cheques written in July cleared the bank in July. Prepare a bank reconciliation. Then, enter the appropriate amounts in the fields below. If you have not added or subtracted an amount to the bank or books, entero. What is the total amount that needs to be ADDED to the bank side? What is the total amount that needs to be SUBTRACTED from the bank side? What is the total amount that needs to be ADDED to the books side? What is the total amount that needs to be SUBTRACTED from the books side? How many journal entries do you have to record for this bank reconciliation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts