Question: QUESTION 19 Continue from previous question: A call option on Santos Limited shares with an exercise price of $7.25 per share, expiry in two months,

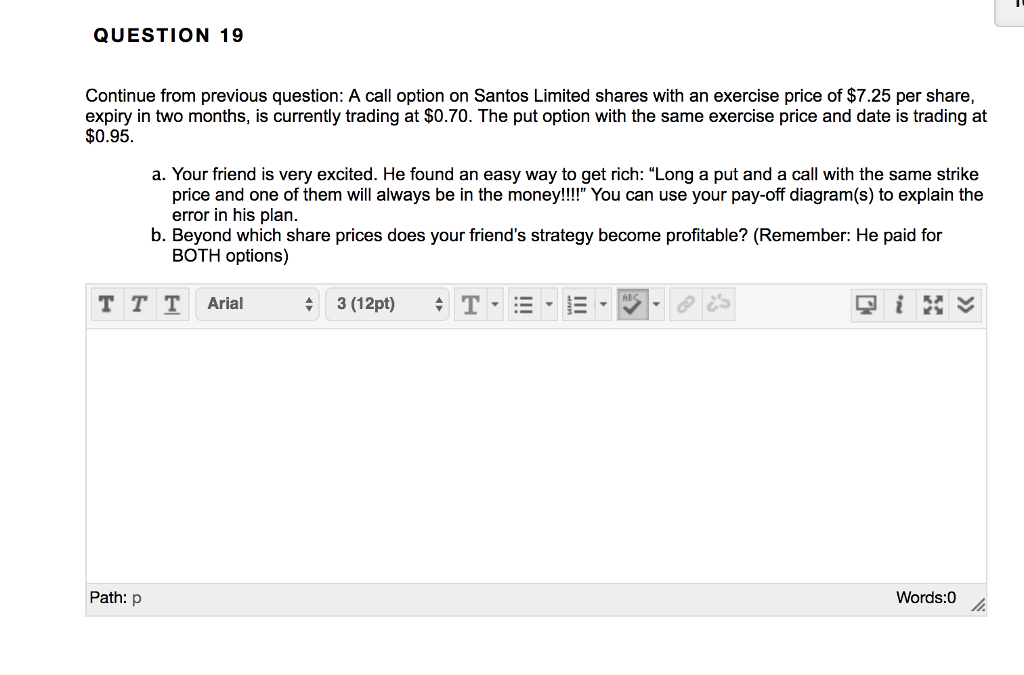

QUESTION 19 Continue from previous question: A call option on Santos Limited shares with an exercise price of $7.25 per share, expiry in two months, is currently trading at $0.70. The put option with the same exercise price and date is trading at a. Your friend is very excited. He found an easy way to get rich: "Long a put and a call with the same strike price and one of them will always be in the money!!!" You can use your pay-off diagram(s) to explain the error in his plan b. Beyond which share prices does your friend's strategy become profitable? (Remember: He paid for BOTH options) Path: p Words:0 QUESTION 19 Continue from previous question: A call option on Santos Limited shares with an exercise price of $7.25 per share, expiry in two months, is currently trading at $0.70. The put option with the same exercise price and date is trading at a. Your friend is very excited. He found an easy way to get rich: "Long a put and a call with the same strike price and one of them will always be in the money!!!" You can use your pay-off diagram(s) to explain the error in his plan b. Beyond which share prices does your friend's strategy become profitable? (Remember: He paid for BOTH options) Path: p Words:0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts