Question: QUESTION 19 In order to retain certain key executives, Smiley Corporation granted them incentive stock options on December 31, 2021. 100,000 options were granted at

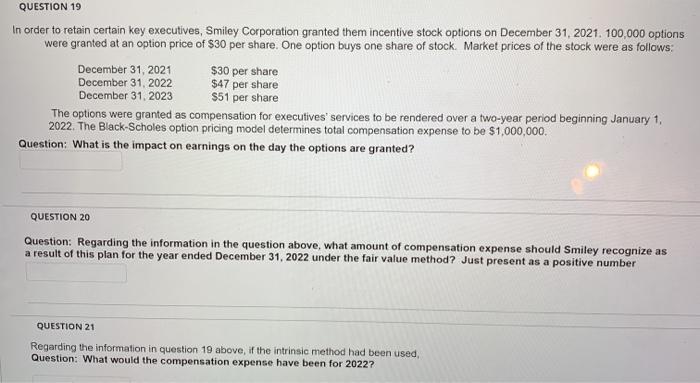

QUESTION 19 In order to retain certain key executives, Smiley Corporation granted them incentive stock options on December 31, 2021. 100,000 options were granted at an option price of $30 per share. One option buys one share of stock Market prices of the stock were as follows: December 31, 2021 $30 per share December 31, 2022 $47 per share December 31, 2023 $51 per share The options were granted as compensation for executives' services to be rendered over a two-year period beginning January 1, 2022. The Black-Scholes option pricing model determines total compensation expense to be $1,000,000. Question: What is the impact on earnings on the day the options are granted? QUESTION 20 Question: Regarding the information in the question above, what amount of compensation expense should Smiley recognize as a result of this plan for the year ended December 31, 2022 under the fair value method? Just present as a positive number QUESTION 21 Regarding the information in question 19 above, if the intrinsic method had been used, Question: What would the compensation expense have been for 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts