Question: Question 19 needs solution process, not question 16. 16. Your client's degree of risk aversion is A = 3.5. a. What proportion (y) of the

Question 19 needs solution process, not question 16.

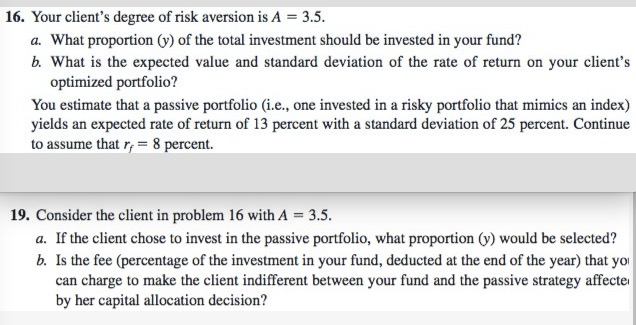

16. Your client's degree of risk aversion is A = 3.5. a. What proportion (y) of the total investment should be invested in your fund? b. What is the expected value and standard deviation of the rate of return on your client's optimized portfolio? You estimate that a passive portfolioi.e., one invested in a risky portfolio that mimics an index) yields an expected rate of return of 13 percent with a standard deviation of 25 percent. Continue to assume that r 8 percent. 19. Consider the client in problem 16 with A a. If the client chose to invest in the passive portfolio, what proportion (v) would be selected? b. Is the fee (percentage of the investment in your fund, deducted at the end of the year) that yo can charge to make the client indifferent between your fund and the passive strategy affecte by her capital allocation decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts