Question: QUESTION 19 What is the yield to maturity on a 14-year to maturity, 7% annual coupon payments, $1,000 Face value bond that sells for the

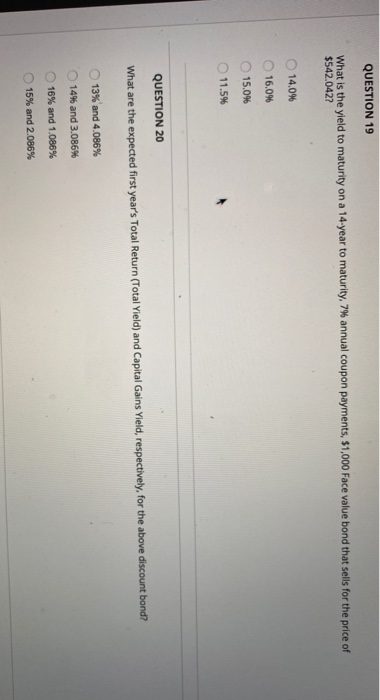

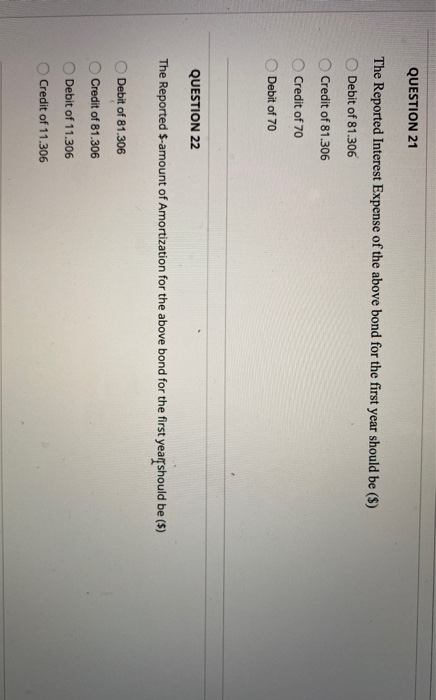

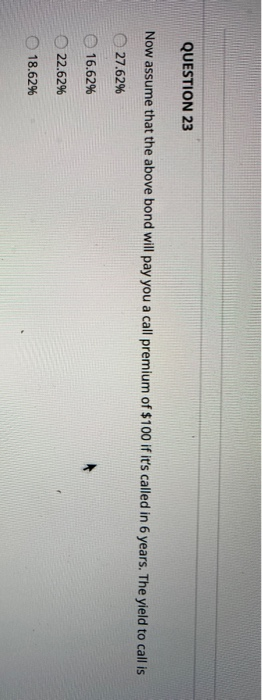

QUESTION 19 What is the yield to maturity on a 14-year to maturity, 7% annual coupon payments, $1,000 Face value bond that sells for the price of $542.0422 14.0% 16.0% 15.0% 11.5% QUESTION 20 What are the expected first year's Total Return (Total Yield) and Capital Gains Yield, respectively, for the above discount bond? 13% and 4.086% 14% and 3.086% 16% and 1.086% 15% and 2.086% QUESTION 21 The Reported Interest Expense of the above bond for the first year should be ($) Debit of 81.306 Credit of 81.306 Credit of 70 Debit of 70 QUESTION 22 The Reported $-amount of Amortization for the above bond for the first yearshould be (s) Debit of 81.306 Credit of 81.306 Debit of 11.306 Credit of 11.306 QUESTION 23 Now assume that the above bond will pay you a call premium of $100 if it's called in 6 years. The yield to call is 27.62% 16.62% 22.62% 18.62%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts