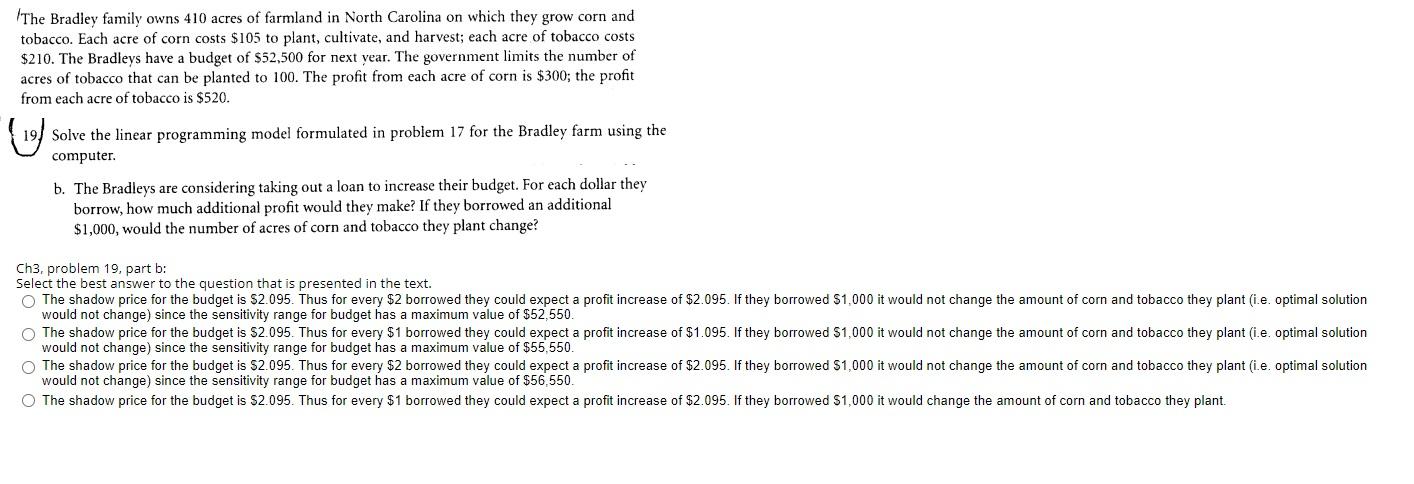

Question: Question 19.B Choose from the multiple choice. Any work shown is much appreciated. The Bradley family owns 410 acres of farmland in North Carolina on

Question 19.B

Choose from the multiple choice. Any work shown is much appreciated.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock