Question: Question 1B only. 1. a) Perform an attribution analysis for the portfolio versus the benchmark given the following data. Calculate allocation effect, selection effect, and

Question 1B only.

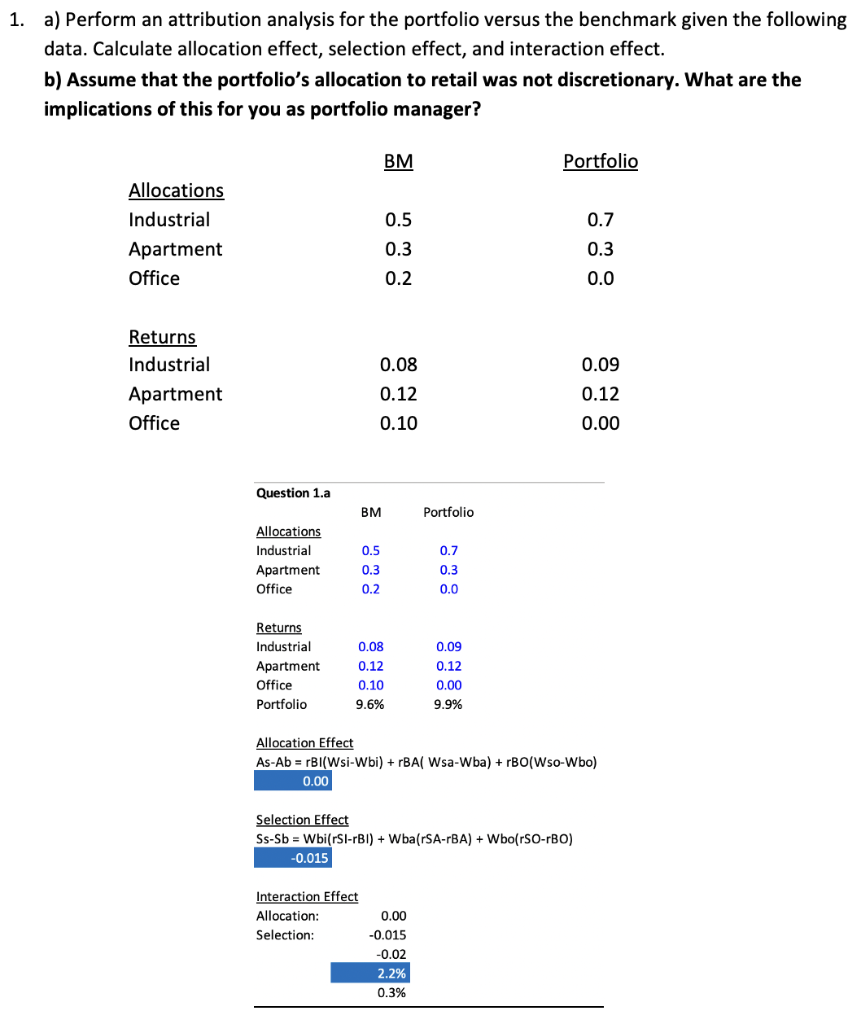

1. a) Perform an attribution analysis for the portfolio versus the benchmark given the following data. Calculate allocation effect, selection effect, and interaction effect. b) Assume that the portfolio's allocation to retail was not discretionary. What are the implications of this for you as portfolio manager? BM Portfolio 0.5 Allocations Industrial Apartment Office 0.3 0.7 0.3 0.0 0.2 0.08 0.09 Returns Industrial Apartment Office 0.12 0.12 0.10 0.00 Question 1.a BM Portfolio 0.5 0.7 Allocations Industrial Apartment Office 0.3 0.2 0.3 0.0 Returns Industrial Apartment Office Portfolio 0.08 0.12 0.10 9.6% 0.09 0.12 0.00 9.9% Allocation Effect As-Ab = rBI(Wsi-Wbi) + BA Wsa-Wba) + BO(W5o-Wbo) 0.00 Selection Effect Ss-Sb = Wbi(rSi-rBI) + WbarSA-BA) + Wbo(rSO-BO) -0.015 Interaction Effect Allocation: Selection: 0.00 -0.015 -0.02 2.2% 0.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts