Question: Question 1b please solve it, with explanation and formula. The 7.2% is a monthly rate, that's what the professor said. The answer in the second

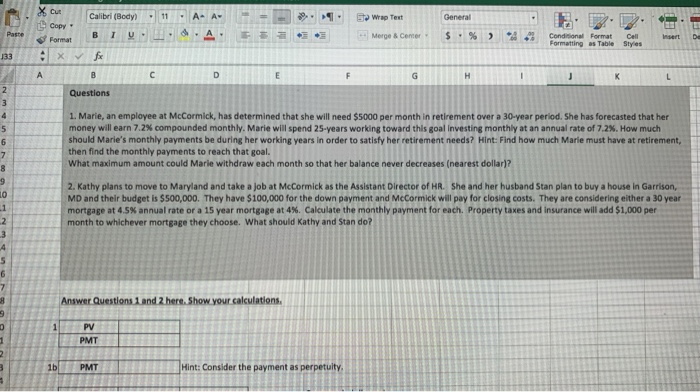

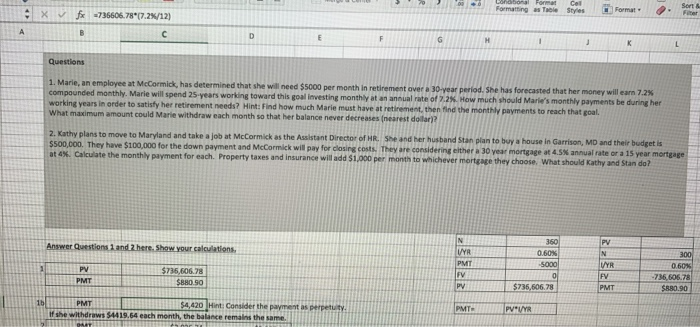

X Cut 11 - AA- Wrap Text General Paste Calibri (Body B 1 U- Copy Format 8.A F Merge & Center $. % ) Insert DE Conditional Format Cell Formatting as Table Styles 133 X fox D E F G H 1 L Questions 2 3 4 5 6 7 8 1. Marie, an employee at McCormick, has determined that she will need $5000 per month in retirement over a 30-year period. She has forecasted that her money will earn 7.2% compounded monthly. Marie will spend 25-years working toward this goal Investing monthly at an annual rate of 7.2%. How much should Marie's monthly payments be during her working years in order to satisfy her retirement needs? Hint: Find how much Marie must have at retirement, then find the monthly payments to reach that goal. What maximum amount could Marie withdraw each month so that her balance never decreases (nearest dollar)? 2. Kathy plans to move to Maryland and take a job at McCormick as the Assistant Director of HR. She and her husband Stan plan to buy a house in Garrison, MD and their budget is $500,000. They have $100,000 for the down payment and McCormick will pay for closing costs. They are considering either a 30 year mortgage at 4.5% annual rate or a 15 year mortgage at 4%. Calculate the monthly payment for each. Property taxes and insurance will add $1,000 per month to whichever mortgage they choose. What should Kathy and Stando? 9 10 2 3 4 5 6 7 8 Answer Questions 1 and 2 here. Show your calculations, 1 PV PMT 1 2 1b PMT Hint: Consider the payment as perpetuity, 11 000 Concorde Cat Formatting as Table Styles Format X Sort & Filter fx -736606.78*17.28/12) B D F G H K L Questions 1. Marie, an employee at McCormick, has determined that she will need $5000 per month in retirement over a 30-year period. She has forecasted that her money will earn 7.2% compounded monthly Marie will spend 25 years working toward this goal investing monthly at an annual rate of 2.2%. How much should Marle's monthly payments be during her working years in order to satisfy her retirement needs? Hint: Find how much Marie must have at retirement, then find the monthly payments to reach that goal. What maximum amount could Marle withdraw each month so that her balance never decreases (nearest dollar? 2. Kathy plans to move to Maryland and take a job at McCormick as the Assistant Director of HR. She and her husband Stan plan to buy a house in Garrison, MD and their budget is $500,000. They have $100,000 for the down payment and McCormick will pay for closing costs. They are considering either a 30 year mortgage at 4.5% annual rate or a 15 year mortgage at 4%. Calculate the monthly payment for each. Property taxes and insurance will add $1,000 per month to whichever mortgage they choose. What should Kathy and Stando? N Answer Questions and 2 here. Show your calculations, PV N PV PMT $736,606.78 $880.90 WYR PMT FV PV 360 0.60% -5000 0 $736.606.78 VYR FV PMT 300 0.60% -736.606.78 $880.90 15 PMT $4,420 Hint: Consider the payment as perpetuty If she withdraws $4419.64 each month, the balance remains the same PMT PV/YR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts