Question: Question 1B Using the market data in the table below and a risk-free rate of 0.5% per semi-annum. Calculate the implied volatility of stock NVIDIA

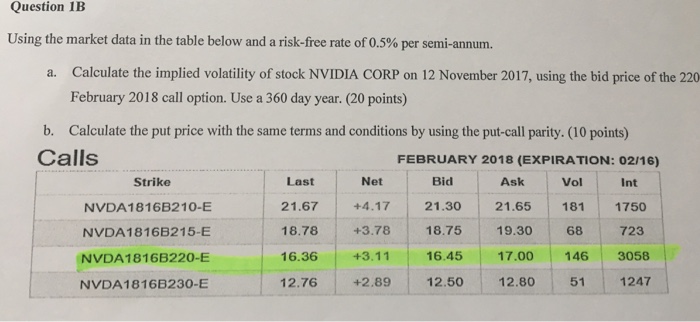

Question 1B Using the market data in the table below and a risk-free rate of 0.5% per semi-annum. Calculate the implied volatility of stock NVIDIA CORP on 12 November 2017, using the bid price of the 220 February 2018 call option. Use a 360 day year. (20 points) a. b. Calculate the put price with the same terms and conditions by using the put-call parity. (10 points) Calls FEBRUARY 2018 (EXPIRATION: 02116) Strike NVDA18168210-E NVDA18168215-E NVDA1816B220-E NVDA18168230-E Net Bid Ask Last 21.67+4.17 21.30 21.65181 1750 18.78 +3.78 18.75 19.30 68 723 16.36 +3.11 12.76 +2.89 12.50 12.8051 1247 Vol Int 16.45 17.00 146 3058

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock