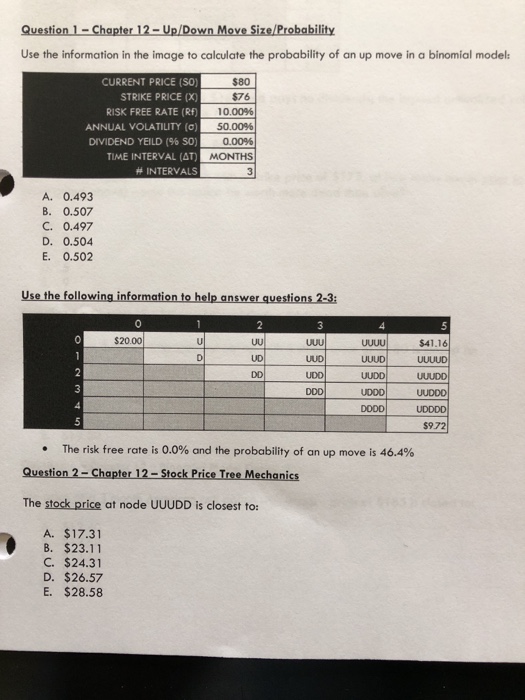

Question: Question 1-Chapter 12-Up/Down Move Size/Probability Use the information in the image to calculate the probability of an up move in a binomial model: CURRENT PRICE

Question 1-Chapter 12-Up/Down Move Size/Probability Use the information in the image to calculate the probability of an up move in a binomial model: CURRENT PRICE (SO) STRIKE PRICE (X) RISK FREE RATE (Rf) ANNUAL VOLATILITY (a) DIVIDEND YELD (96 SO) TIME INTERVAL (AT) $80 $76 10.00% 50,00% 0.00% MONTHS # INTERVAL A. 0.493 B. 0.507 C. 0.497 D. 0.504 E. 0.502 Use the following information to help answer questions 2-3 $20.00 $41.16 UUD UDO DOD UUUD UUDD UDOO DODD 5 $972 The risk free rate is 0.0% and the probability of an up move is 46.4% . Question 2-Chapter 12-Stock Price Tree Mechanics The stock price at node UUUDD is closest to: A. $17.31 B. $23.11 C. $24.31 D. $26.57 E. $28.58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts