Question: Question 2 0 / 20 pts Gamma Inc. bought new office furniture in the year 2002. The purchase cost was 99,238 dollars and in addition

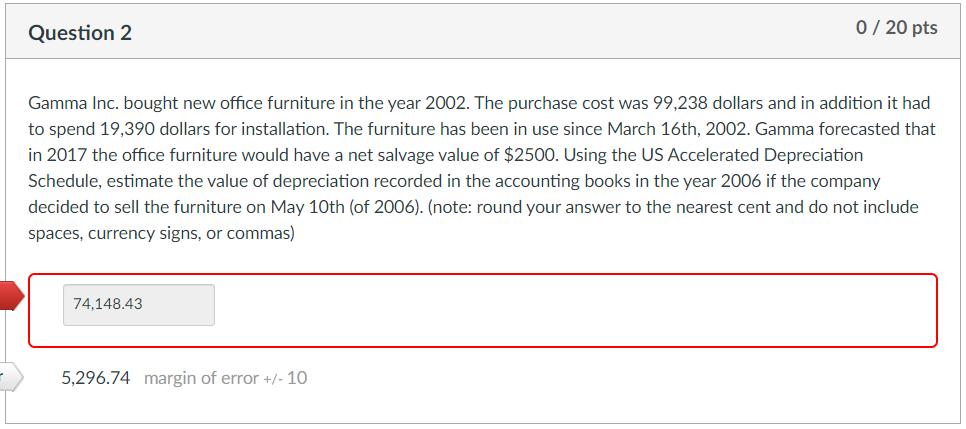

Question 2 0 / 20 pts Gamma Inc. bought new office furniture in the year 2002. The purchase cost was 99,238 dollars and in addition it had to spend 19,390 dollars for installation. The furniture has been in use since March 16th, 2002. Gamma forecasted that in 2017 the office furniture would have a net salvage value of $2500. Using the US Accelerated Depreciation Schedule, estimate the value of depreciation recorded in the accounting books in the year 2006 if the company decided to sell the furniture on May 10th (of 2006). (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas) 74,148.43 5,296.74 margin of error +/- 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts