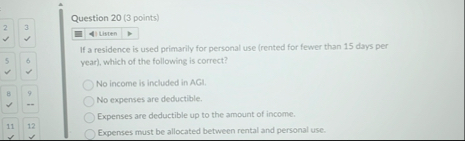

Question: Question 2 0 ( 3 points ) 2 3 If a residence is used primarily for personal use ( rented for fewer than 1 5

Question points

If a residence is used primarily for personal use rented for fewer than days per

year which of the following is correct?

No income is included in AGI

No exmentes are deductible

Expenses are deductible up to the amount of income.

Expenses must be allocated between rental and personal use.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock