Question: Question 2 0/0.5 points Quality Tools, Inc. needs to purchase a new machine costing $2.08 million. Management is estimating the machine will generate cash inflows

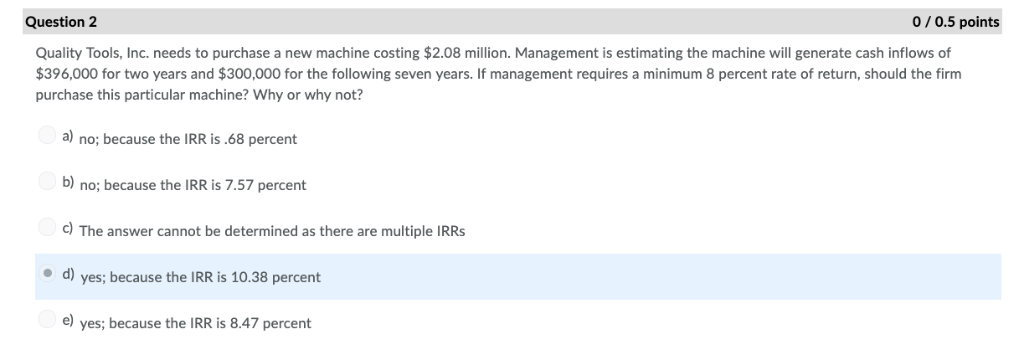

Question 2 0/0.5 points Quality Tools, Inc. needs to purchase a new machine costing $2.08 million. Management is estimating the machine will generate cash inflows of $396,000 for two years and $300,000 for the following seven years. If management requires a minimum 8 percent rate of return, should the firm purchase this particular machine? Why or why not? a) no; because the IRR is.68 percent b) no; because the IRR is 7.57 percent c) The answer cannot be determined as there are multiple IRRs d) yes; because the IRR is 10.38 percent e) yes; because the IRR is 8.47 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts