Question: QUESTION 2 0.5 points Saved > Scott & Tim's Delivery Corporation (S&T) is a new parcel delivery company incorporated in New York. The company has

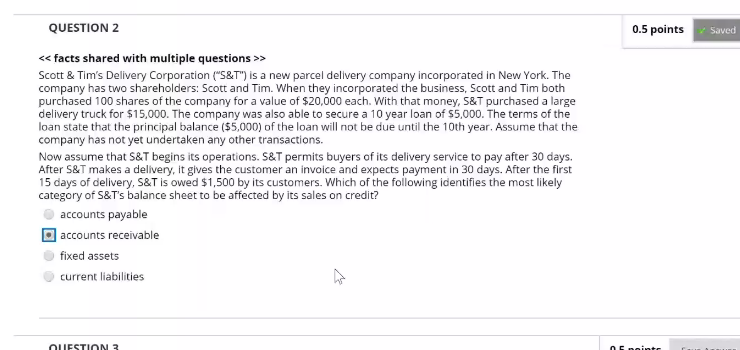

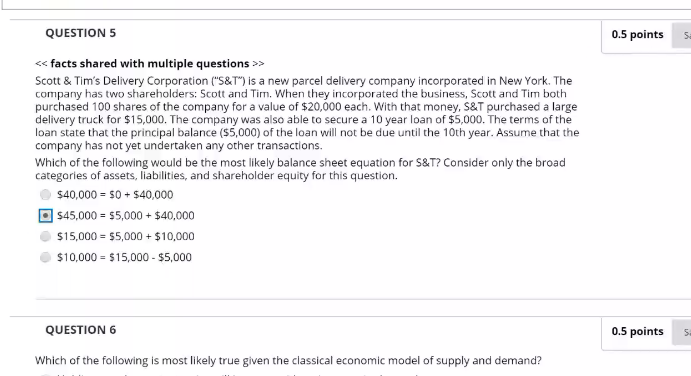

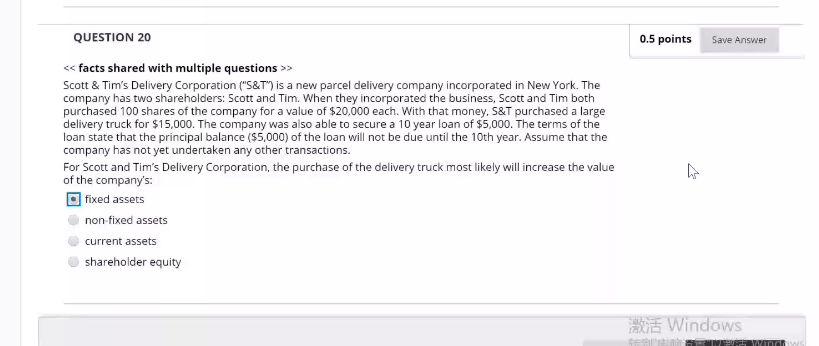

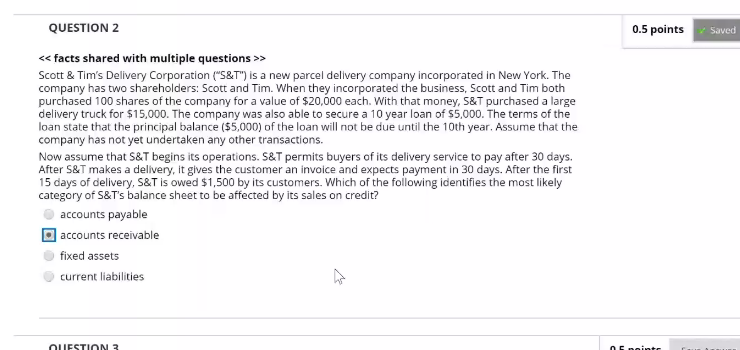

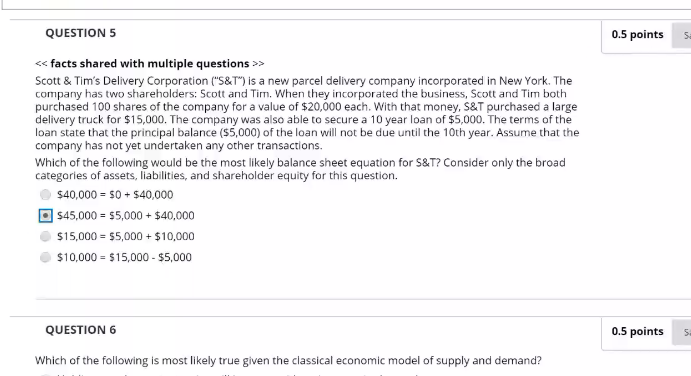

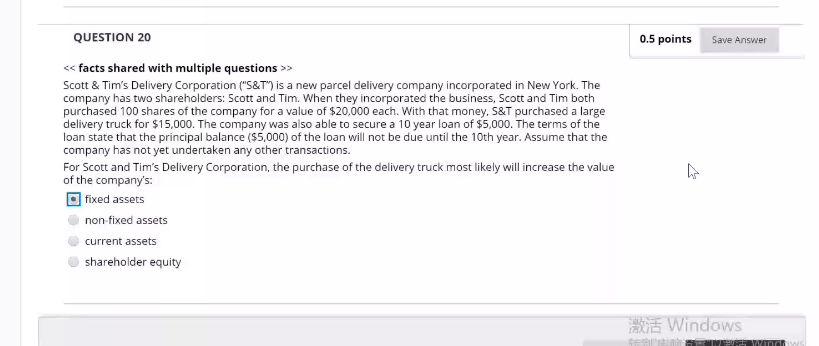

QUESTION 2 0.5 points Saved > Scott & Tim's Delivery Corporation ("S&T") is a new parcel delivery company incorporated in New York. The company has two shareholders: Scott and Tim. When they incorporated the business, Scott and Tim both purchased 100 shares of the company for a value of $20,000 each. With that money, S&T purchased a large delivery truck for $15,000. The company was also able to secure a 10 year loan of $5,000. The terms of the loan state that the principal balance ($5,000) of the loan will not be due until the 10th year. Assume that the company has not yet undertaken any other transactions. Now assume that S&T begins its operations. S&T permits buyers of its delivery service to pay after 30 days. After S&T makes a delivery, it gives the customer an invoice and expects payment in 30 days. After the first 15 days of delivery, S&T is owed $1,500 by its customers. Which of the following identifies the most likely category of S&T's balance sheet to be affected by its sales on credit? accounts payable | accounts receivable fixed assets current liabilities h QUESTION 2 ciste QUESTION 5 0.5 points SE > Scott & Tim's Delivery Corporation ("S&T") is a new parcel delivery company incorporated in New York. The company has two shareholders: Scott and Tim. When they incorporated the business, Scott and Tim both purchased 100 shares of the company for a value of $20,000 each. With that money, S&T purchased a large delivery truck for $15,000. The company was also able to secure a 10 year loan of $5,000. The terms of the loan state that the principal balance ($5,000) of the loan will not be due until the 10th year. Assume that the company has not yet undertaken any other transactions. Which of the following would be the most likely balance sheet equation for S&T? Consider only the broad Categories of assets, liabilities, and shareholder equity for this question. $40,000 = 50 + $40,000 $45,000 = $5,000 + $40,000 $15,000 = $5,000 + $10,000 $10,000 = $15,000 - $5,000 + QUESTION 6 0.5 points 5 Which of the following is most likely true given the classical economic model of supply and demand? QUESTION 20 0.5 points Save Answer facts shared with multiple questions >> Scott & Tim's Delivery Corporation ("S&T") is a new parcel delivery company incorporated in New York. The company has two shareholders: Scott and Tim. When they incorporated the business, Scott and Tim both purchased 100 shares of the company for a value of $20,000 each. With that money, S&T purchased a large delivery truck for $15,000. The company was also able to secure a 10 year loan of $5,000. The terms of the loan state that the principal balance ($5,000) of the loan will not be due until the 10th year. Assume that the company has not yet undertaken any other transactions. For Scott and Tim's Delivery Corporation, the purchase of the delivery truck most likely will increase the value of the company's: fixed assets non-fixed assets current assets shareholder equity Windows STUTTAR WA