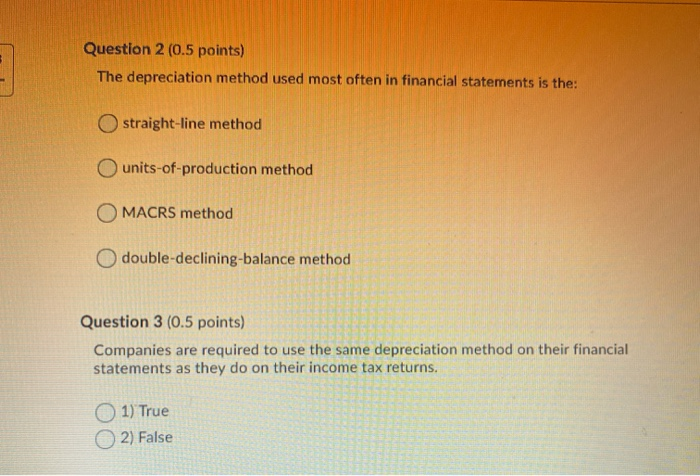

Question: Question 2 (0.5 points) The depreciation method used most often in financial statements is the: O straight-line method units-of-production method O MACRS method double-declining-balance method

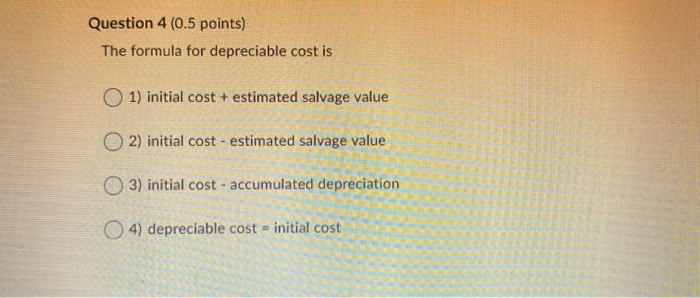

Question 2 (0.5 points) The depreciation method used most often in financial statements is the: O straight-line method units-of-production method O MACRS method double-declining-balance method Question 3 (0.5 points) Companies are required to use the same depreciation method on their financial statements as they do on their income tax returns. 1) True 2) False Question 4 (0.5 points) The formula for depreciable cost is 1) initial cost + estimated salvage value O2) initial cost-estimated salvage value 3) initial cost - accumulated depreciation 4) depreciable cost = initial cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts