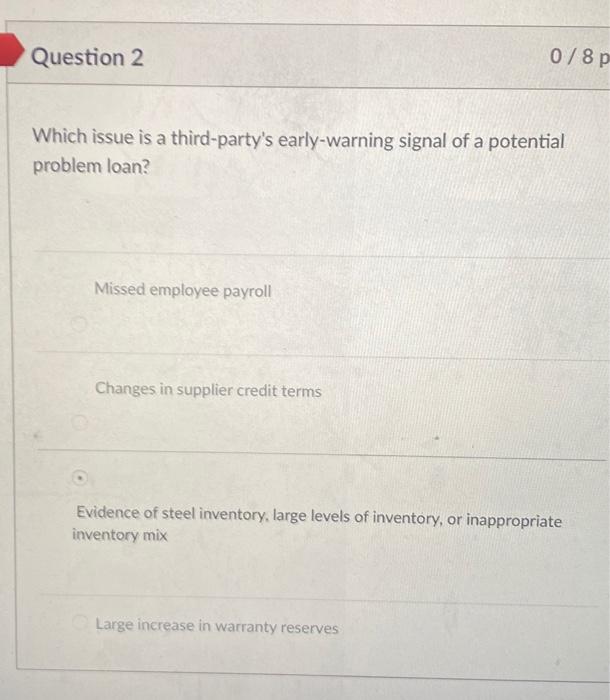

Question: Question 2 0/8 p Which issue is a third-party's early-warning signal of a potential problem loan? Missed employee payroll Changes in supplier credit terms Evidence

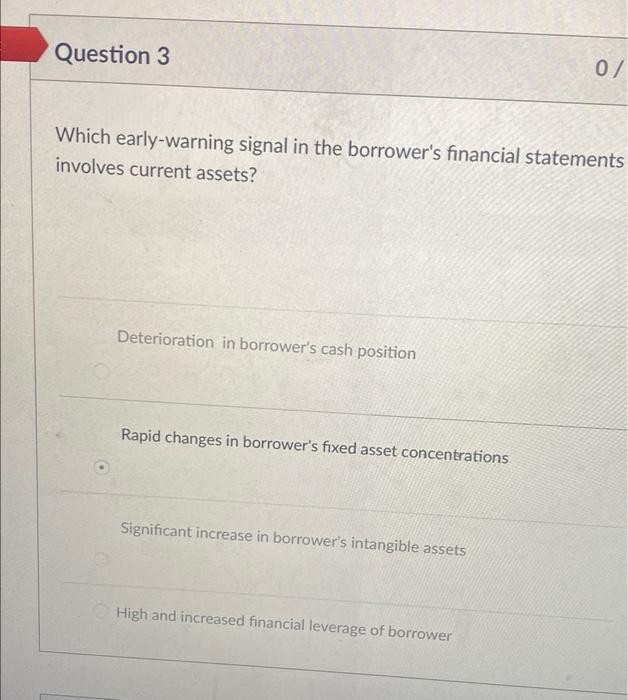

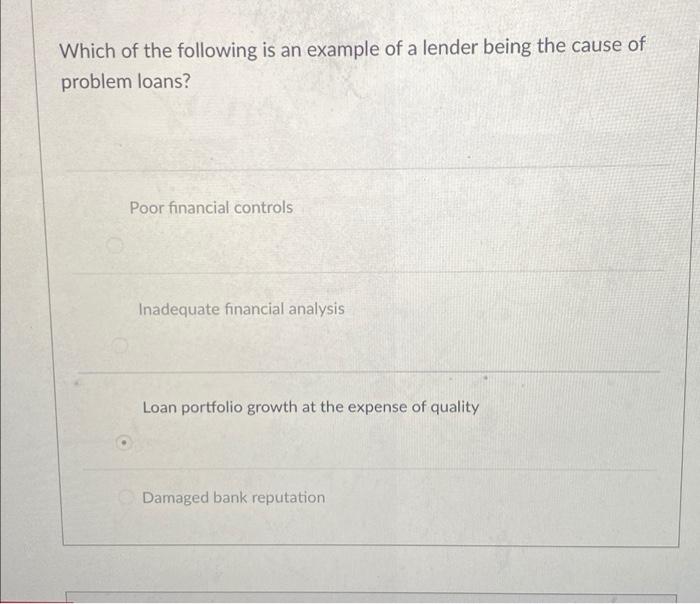

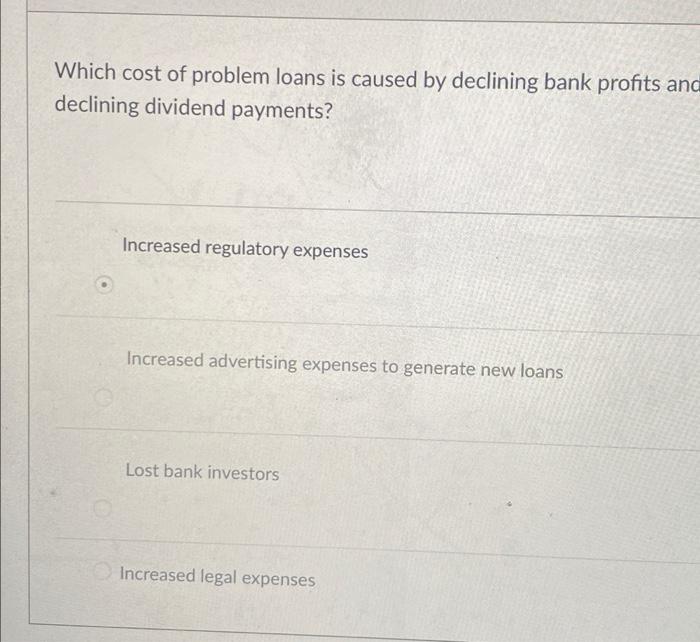

Question 2 0/8 p Which issue is a third-party's early-warning signal of a potential problem loan? Missed employee payroll Changes in supplier credit terms Evidence of steel inventory, large levels of inventory, or inappropriate inventory mix Large increase in warranty reserves Question 3 07 Which early-warning signal in the borrower's financial statements involves current assets? Deterioration in borrower's cash position Rapid changes in borrower's fixed asset concentrations Significant increase in borrower's intangible assets High and increased financial leverage of borrower Which of the following is an example of a lender being the cause of problem loans? Poor financial controls Inadequate financial analysis Loan portfolio growth at the expense of quality Damaged bank reputation Which cost of problem loans is caused by declining bank profits and declining dividend payments? Increased regulatory expenses Increased advertising expenses to generate new loans Lost bank investors Increased legal expenses Which one of the following phrases applies in bankruptcy when debtors transfer assets or take other actions that are deliberately intended to hinder or delay creditors? Proof of claim Preference item Fraudulent conveyance Priority claim In developing a plan of action, which of the following actions is a possible corrective measure? Increasing operating expenses Demanding payment from the borrower and an) guarantors Moving to liquidate the collateral to recoup as much of the bank's debt as possible Acquiring additional capital from owners Which issue is a borrower's non-financial early-warning signal of a problem loan? Suppliers directly charging borrower's checking account for payment Deterioration of the liquidity or working capital position Inability to meet commitments on schedule Loss of any major customers Within the four steps to resolve a problem loan, why is it important to reevaluate the business banker, which is step two of the process? Evaluating the bank's and borrower's strengths and weaknesses helps determine a course of action Some business bankers grow too close to their customers and cannot appraise the situation objectively A new collateral valuation, based on liquidation within a reasonable time, may be needed Until a borrower has been tested by adversity, it is difficult to measure its character

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts