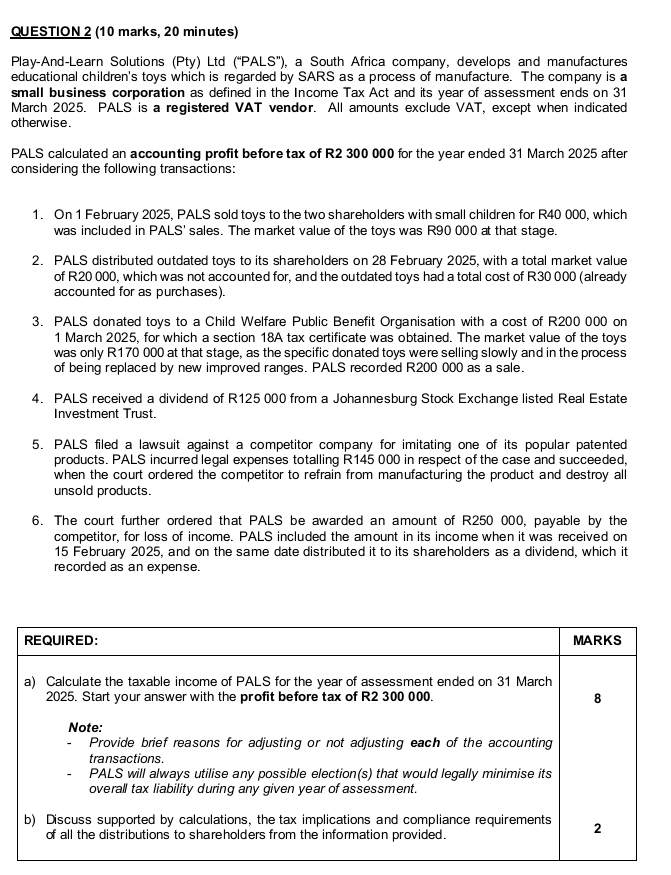

Question: QUESTION 2 ( 1 0 marks, 2 0 minutes ) Play - And - Learn Solutions ( Pty ) Ltd ( PALS )

QUESTION marks, minutes

PlayAndLearn Solutions Pty Ltd PALS a South Africa company, develops and manufactures educational children's toys which is regarded by SARS as a process of manufacture. The company is a small business corporation as defined in the Income Tax Act and its year of assessment ends on March PALS is a registered VAT vendor. All amounts exclude VAT, except when indicated otherwise.

PALS calculated an accounting profit before tax of R for the year ended March after considering the following transactions:

On February PALS sold toys to the two shareholders with small children for R which was included in PALS' sales. The market value of the toys was R at that stage.

PALS distributed outdated toys to its shareholders on February with a total market value of R which was not accounted for, and the outdated toys had a total cost of Ralready accounted for as purchases

PALS donated toys to a Child Welfare Public Benefit Organisation with a cost of R on March for which a section A tax certificate was obtained. The market value of the toys was only R at that stage, as the specific donated toys were selling slowly and in the process of being replaced by new improved ranges. PALS recorded R as a sale.

PALS received a dividend of R from a Johannesburg Stock Exchange listed Real Estate Investment Trust.

PALS filed a lawsuit against a competitor company for imitating one of its popular patented products. PALS incurred legal expenses totalling R in respect of the case and succeeded, when the court ordered the competitor to refrain from manufacturing the product and destroy all unsold products.

The court further ordered that PALS be awarded an amount of R payable by the competitor, for loss of income. PALS included the amount in its income when it was received on February and on the same date distributed it to its shareholders as a dividend, which it recorded as an expense.

tableREQUIRED:MARKStablea Calculate the taxable income of PALS for the year of assessment ended on March Start your answer with the profit before tax of RNote: Provide brief reasons for adjusting or not adjusting each of the accounting transactions. PALS will always utilise any possible elections that would legally minimise its overall tax liability during any given year of assessment.b Discuss supported by calculations, the tax implications and compliance requirements of all the distributions to shareholders from the information provided.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock