Question: Question 2 1 ( 1 0 marks ) Haroid Strutter started a new business in 2 0 2 4 and was very surprised when the

Question marks

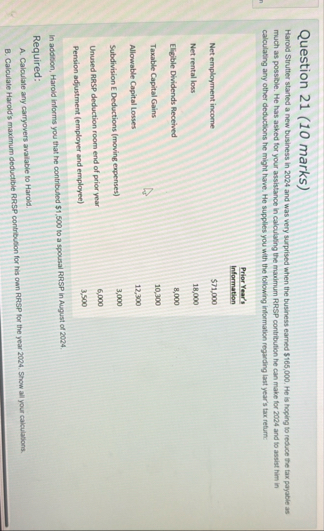

Haroid Strutter started a new business in and was very surprised when the business earned $ He is hoping to reduce the tax payable as much as possible. He has asked for your assistance in calculating the maximum RRSP contribution he can make for and to assist him in calculating any other deductions he might have. He supplies you with the following information regarding last year's tax return:

tablePrior Year's InformationNet employment income,$Net rental loss,Eligible Dividends Received,Taxable Capital Galns,Allowable Capital Losses,Subdivision E Deductions moving expensesUnused RRSP deduction foom end of prior year,Pension adjustment employer and empioyee

In addition, Harold informs you that he contributed $ to a spousal RRSP in August of

Required:

A Calculate any carryovers avalable to Harold.

B Calculate Harold's maximum deductible RRSP contribution for his own RRSP for the year Show all your calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock