Question: Question # 2 ( 1 2 . 5 marks ) Stephen Herron, owner of a small manufacturer, Isis Technology ( IT ) , has asked

Question # marks

Stephen Herron, owner of a small manufacturer, Isis Technology IT has asked you to provide your opinion on the options available to replace an old machine. Two suppliers have provided price and cost estimates. The supplier of the old machine, Canadian Equipment Inc. CEI has improved its equipment but continues with the same specialized design. A new supplier, Alto Design Equipment ADE has a new innovative design that can process any one of the products produced by IT

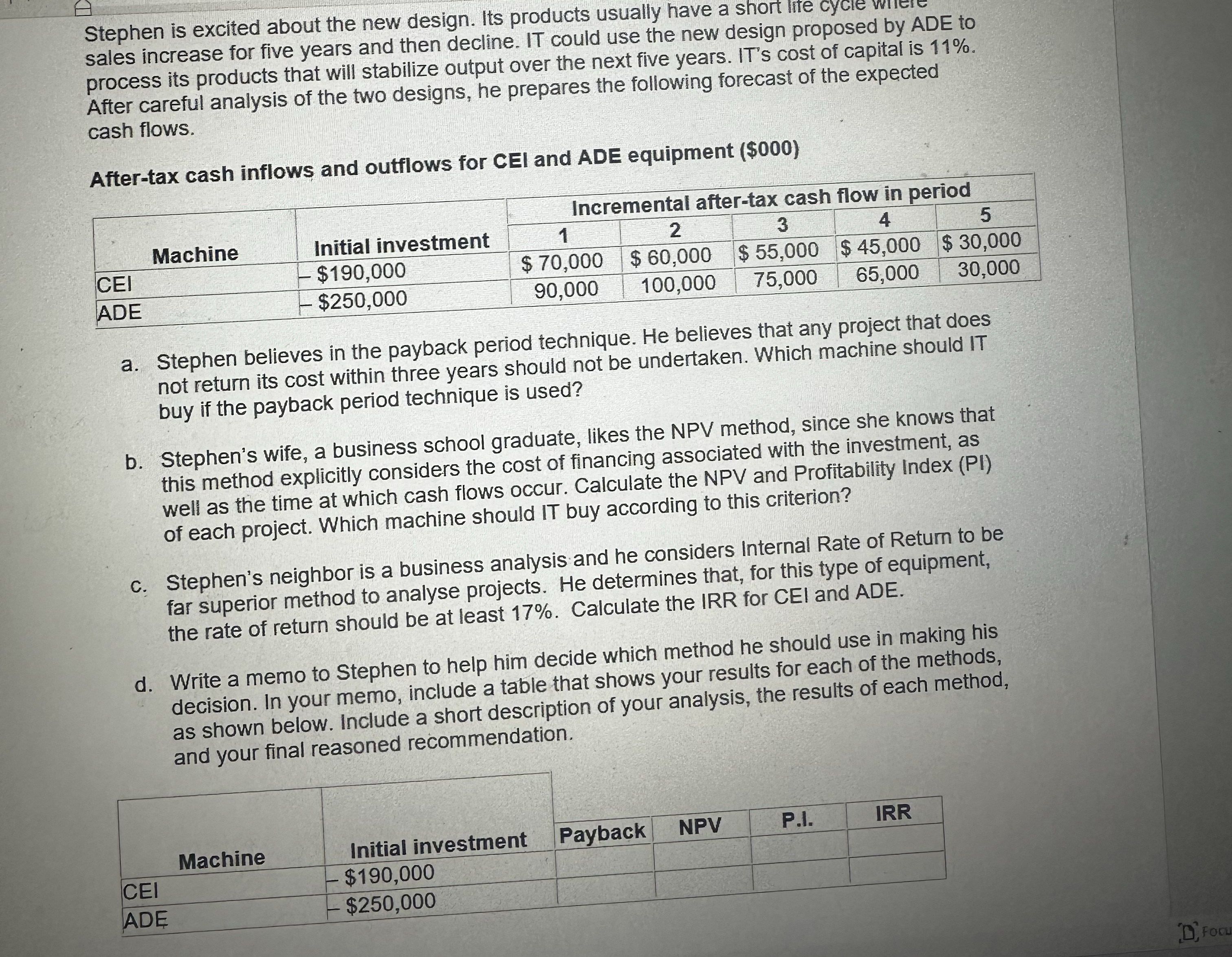

Stephen is excited about the new design. Its products usually have a short life cycle where sales increase for five years and then decline. IT could use the new design proposed by ADE to process its products that will stabilize output over the next five years. IT's cost of capital is After careful analysis of the two designs, he prepares the following forecast of the expected cash flows.

Aftertax cash inflows and outflows for CEI and ADE equipment $

tableMachineInitial investment,Incremental aftertax cash flow in periodtableCEIADE$$$$table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock