Question: Question 2 ( 1 3 marks ) Godfrey has just recovered from a serious illness and is planning to start his early retirement at the

Question marks

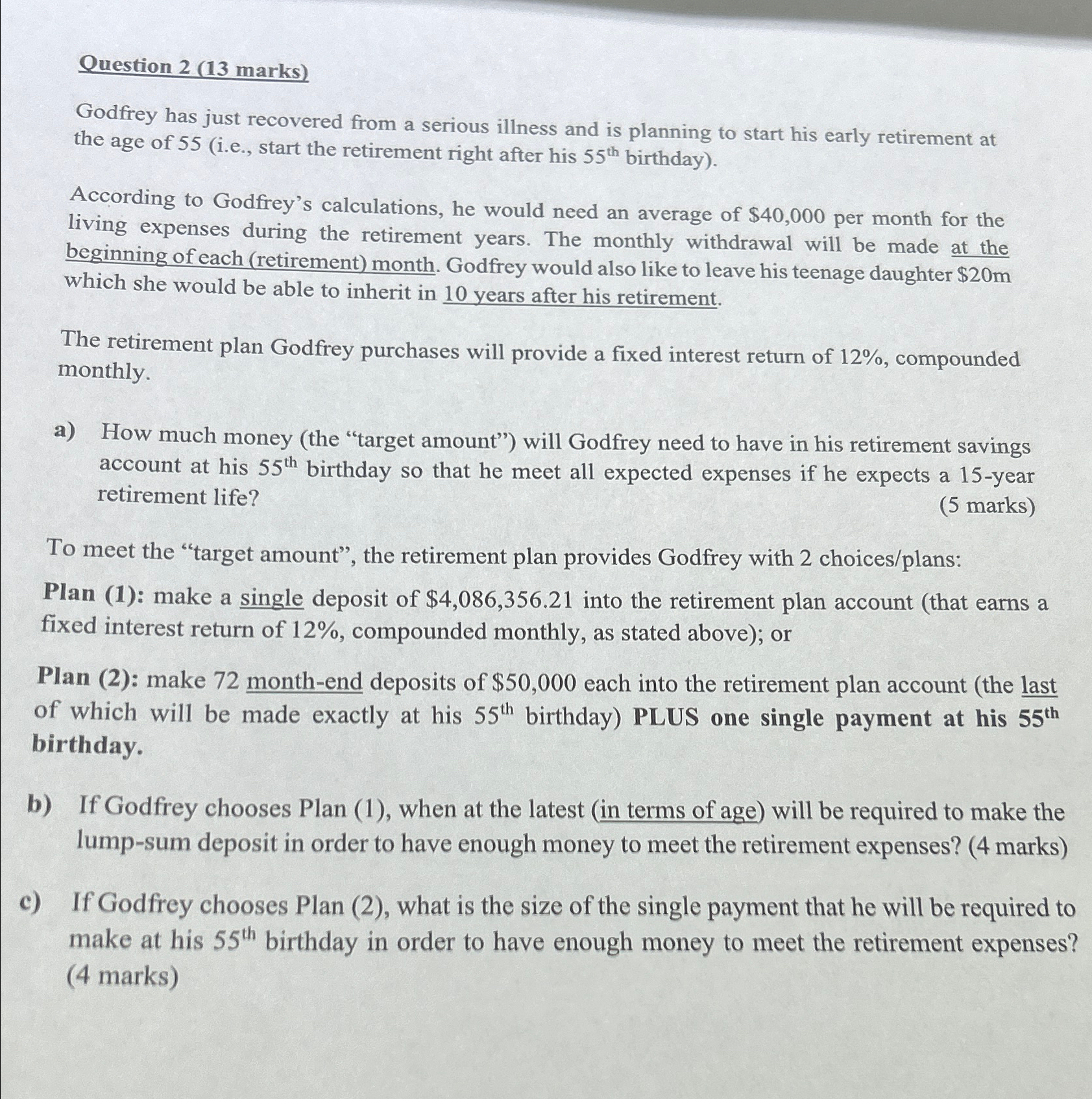

Godfrey has just recovered from a serious illness and is planning to start his early retirement at the age of ie start the retirement right after his birthday

According to Godfrey's calculations, he would need an average of $ per month for the living expenses during the retirement years. The monthly withdrawal will be made at the beginning of each retirement month. Godfrey would also like to leave his teenage daughter $ which she would be able to inherit in years after his retirement.

The retirement plan Godfrey purchases will provide a fixed interest return of compounded monthly.

a How much money the "target amount" will Godfrey need to have in his retirement savings account at his birthday so that he meet all expected expenses if he expects a year retirement life?

marks

To meet the "target amount", the retirement plan provides Godfrey with choicesplans:

Plan : make a single deposit of $ into the retirement plan account that earns a fixed interest return of compounded monthly, as stated above; or

Plan : make monthend deposits of $ each into the retirement plan account the last of which will be made exactly at his birthday PLUS one single payment at his birthday.

b If Godfrey chooses Plan when at the latest in terms of age will be required to make the lumpsum deposit in order to have enough money to meet the retirement expenses? marks

c If Godfrey chooses Plan what is the size of the single payment that he will be required to make at his birthday in order to have enough money to meet the retirement expenses? marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock