Question: Question 2 ( 1 8 marks ) On January 1 , Year 5 , Science Inc. acquired 8 5 % of the common shares of

Question marks

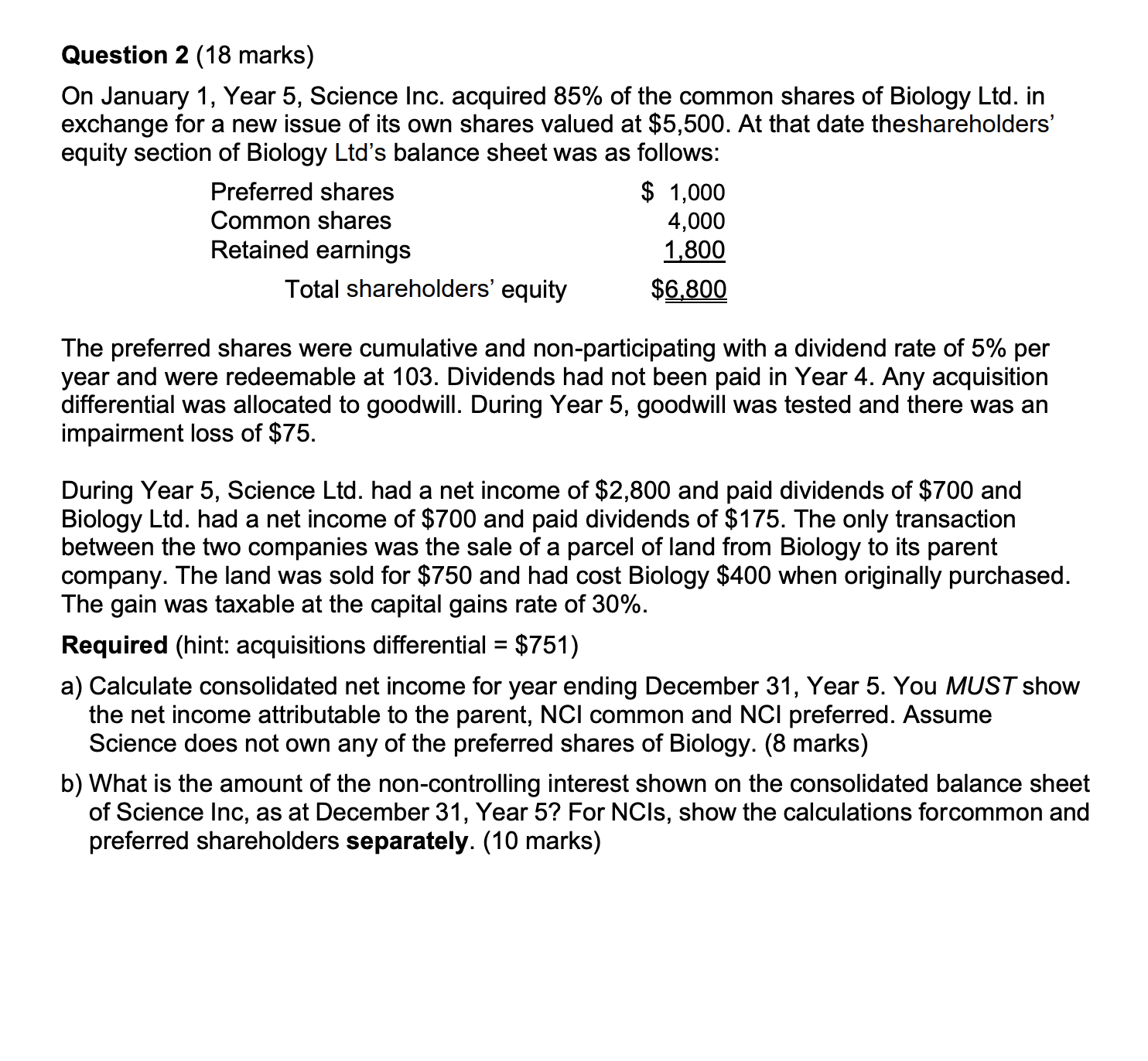

On January Year Science Inc. acquired of the common shares of Biology Ltd in

exchange for a new issue of its own shares valued at $ At that date theshareholders'

equity section of Biology Ltds balance sheet was as follows:

The preferred shares were cumulative and nonparticipating with a dividend rate of per

year and were redeemable at Dividends had not been paid in Year Any acquisition

differential was allocated to goodwill. During Year goodwill was tested and there was an

impairment loss of $

During Year Science Ltd had a net income of $ and paid dividends of $ and

Biology Ltd had a net income of $ and paid dividends of $ The only transaction

between the two companies was the sale of a parcel of land from Biology to its parent

company. The land was sold for $ and had cost Biology $ when originally purchased.

The gain was taxable at the capital gains rate of

Required hint: acquisitions differential $

a Calculate consolidated net income for year ending December Year You MUST show

the net income attributable to the parent, NCl common and NCI preferred. Assume

Science does not own any of the preferred shares of Biology. marks

b What is the amount of the noncontrolling interest shown on the consolidated balance sheet

of Science Inc, as at December Year For NCIs, show the calculations forcommon and

preferred shareholders separately. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock