Question: Question 2 ( 1 8 points ) a . You speculate that TL appreciates to USD . 3 3 / TL and you want to

Question points

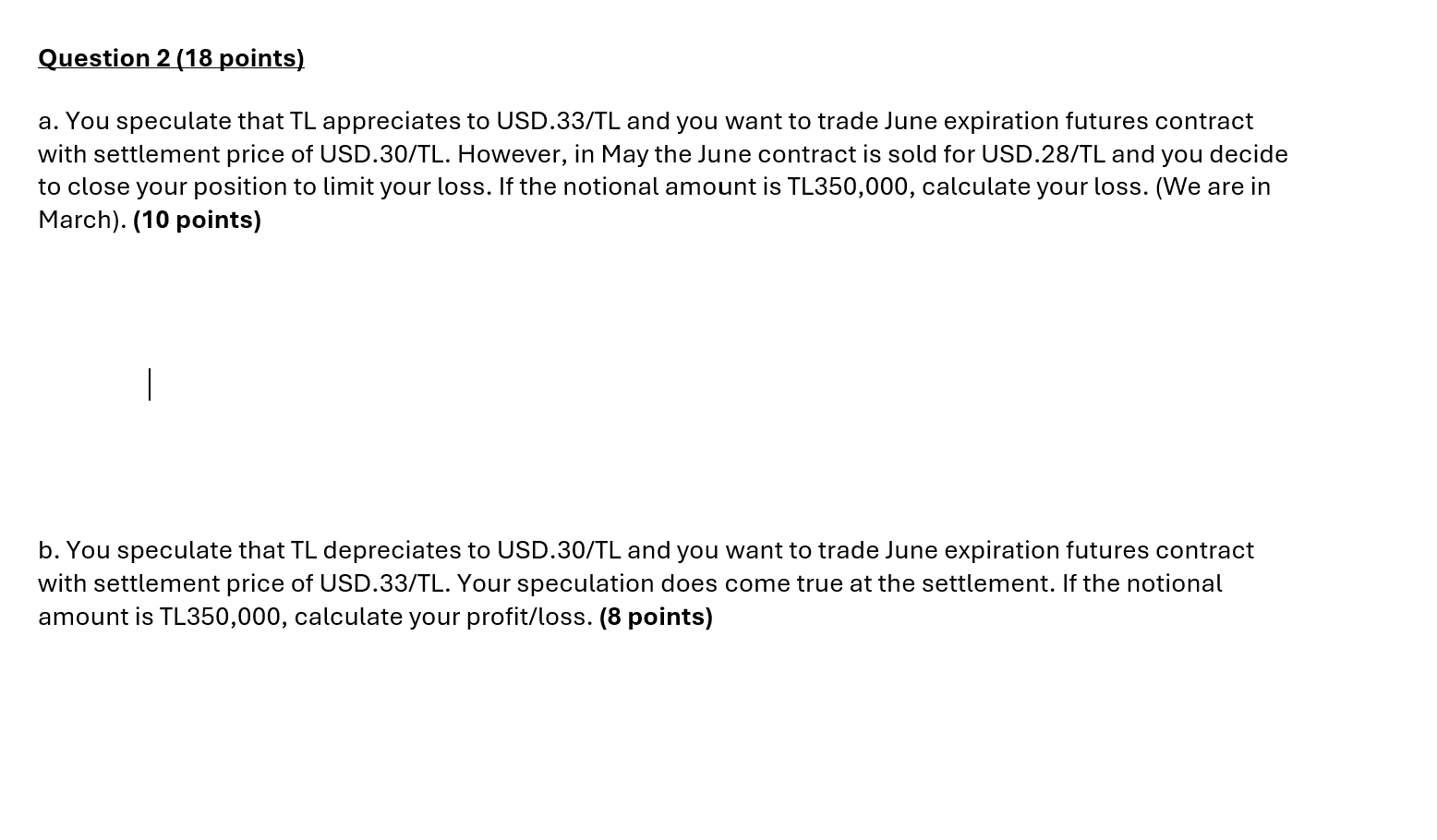

a You speculate that TL appreciates to USDTL and you want to trade June expiration futures contract with settlement price of USDTL However, in May the June contract is sold for USDTL and you decide to close your position to limit your loss. If the notional amount is TL calculate your loss. We are in March points

b You speculate that TL depreciates to USDTL and you want to trade June expiration futures contract with settlement price of USDTL Your speculation does come true at the settlement. If the notional amount is TL calculate your profitloss points

Question points

a You speculate that TL appreciates to USDTL and you want to trade June expiration futures contract

with settlement price of USDTL However, in May the June contract is sold for USDTL and you decide

to close your position to limit your loss. If the notional amount is TL calculate your loss. We are in

March points

b You speculate that TL depreciates to USDTL and you want to trade June expiration futures contract

with settlement price of USDTL Your speculation does come true at the settlement. If the notional

amount is TL calculate your profitloss points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock