Question: QUESTION 2 1. Consider the following version of the earned income tax credit (EITC). All persons who earn less than $20,000 are given a wage

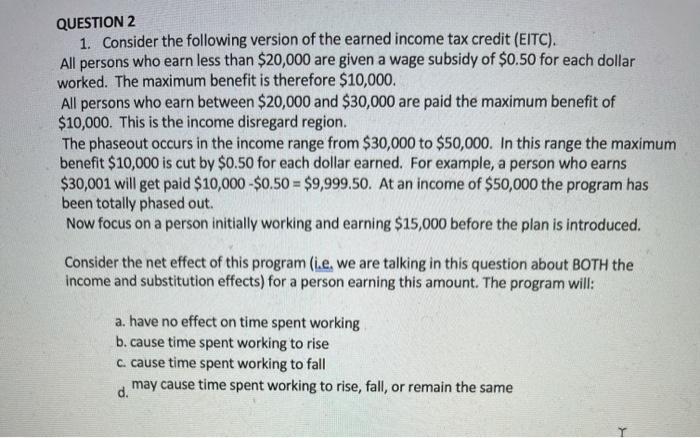

QUESTION 2 1. Consider the following version of the earned income tax credit (EITC). All persons who earn less than $20,000 are given a wage subsidy of $0.50 for each dollar worked. The maximum benefit is therefore $10,000. All persons who earn between $20,000 and $30,000 are paid the maximum benefit of $10,000. This is the income disregard region. The phaseout occurs in the income range from $30,000 to $50,000. In this range the maximum benefit $10,000 is cut by $0.50 for each dollar earned. For example, a person who earns $30,001 will get paid $10,000 - $0.50 = $9,999.50. At an income of $50,000 the program has been totally phased out. Now focus on a person initially working and earning $15,000 before the plan is introduced. Consider the net effect of this program (ie, we are talking in this question about BOTH the income and substitution effects) for a person earning this amount. The program will: a. have no effect on time spent working b.cause time spent working to rise c. cause time spent working to fall d. may cause time spent working to rise, fall, or remain the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts