Question: Question 2 1 Multiple choice, mark all the correct answers. There may be more than one or no correct answer. Beta measures the systematic risk

Question

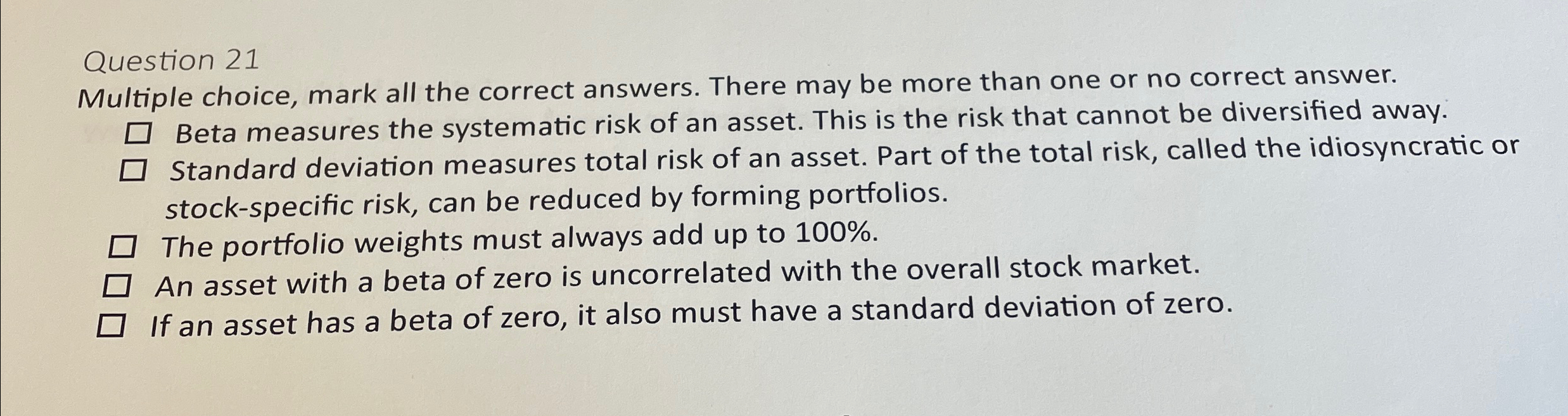

Multiple choice, mark all the correct answers. There may be more than one or no correct answer.

Beta measures the systematic risk of an asset. This is the risk that cannot be diversified away. Standard deviation measures total risk of an asset. Part of the total risk, called the idiosyncratic or stockspecific risk, can be reduced by forming portfolios.

The portfolio weights must always add up to

An asset with a beta of zero is uncorrelated with the overall stock market.

If an asset has a beta of zero, it also must have a standard deviation of zero.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock