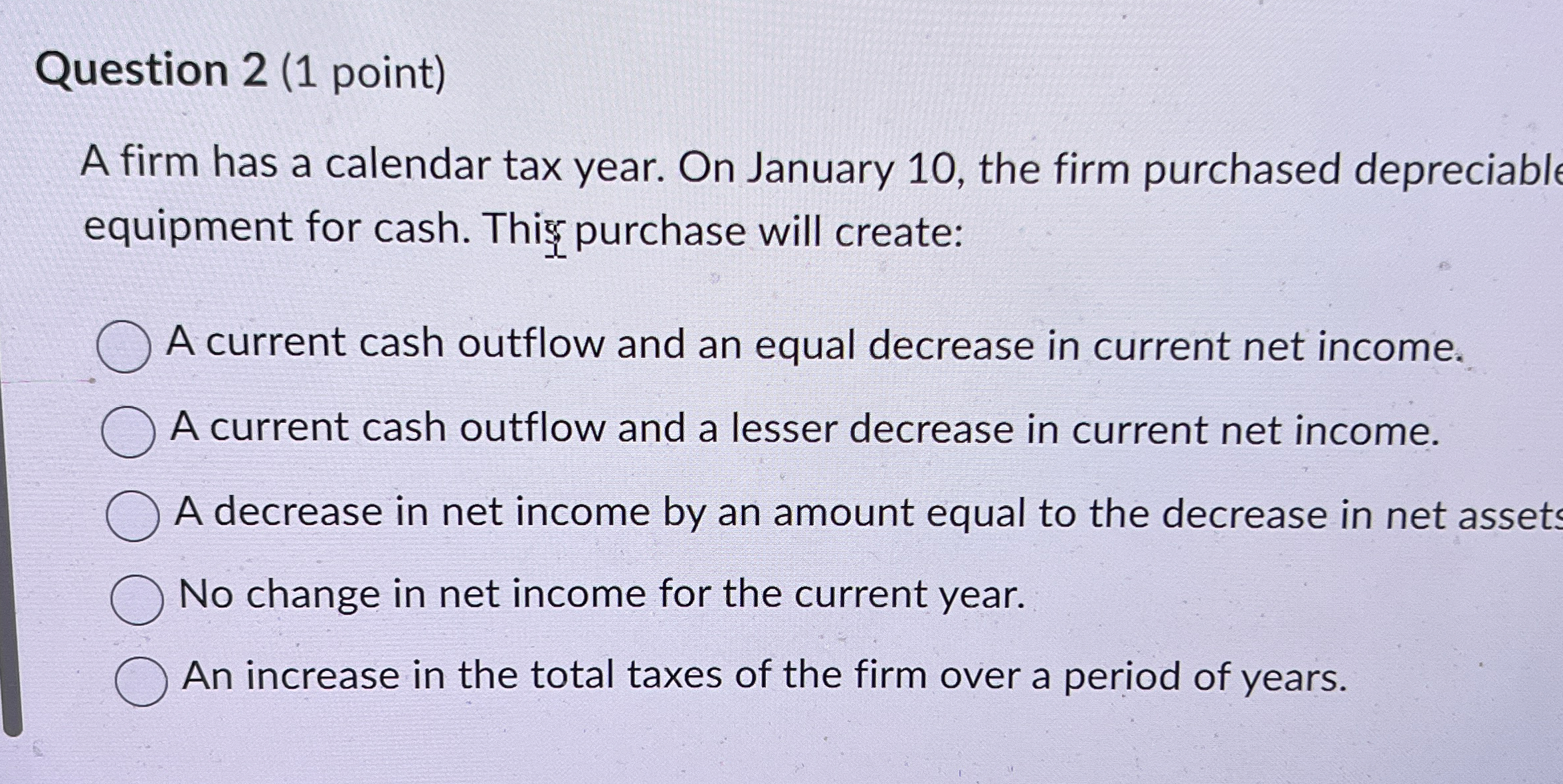

Question: Question 2 ( 1 point ) A firm has a calendar tax year. On January 1 0 , the firm purchased depreciable equipment for cash.

Question point

A firm has a calendar tax year. On January the firm purchased depreciable

equipment for cash. This purchase will create:

A current cash outflow and an equal decrease in current net income.

A current cash outflow and a lesser decrease in current net income.

A decrease in net income by an amount equal to the decrease in net asset

No change in net income for the current year.

An increase in the total taxes of the firm over a period of years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock