Question: Question 2 (1 point) Alan met with Donna, a new prospect for disability insurance. Donna did not always seem to grasp the importance of the

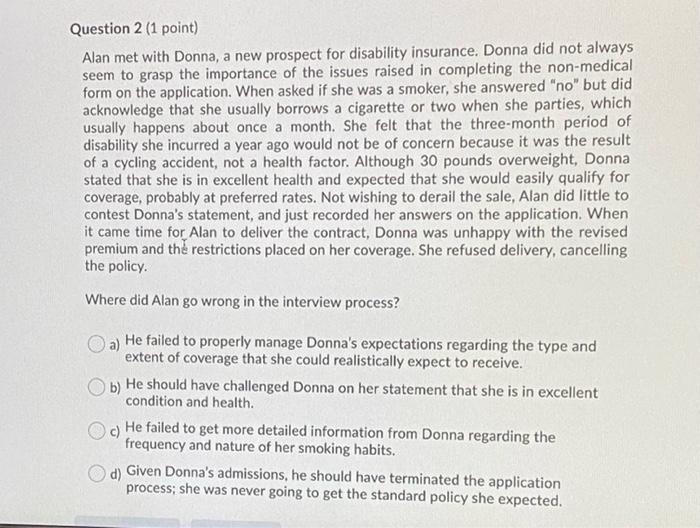

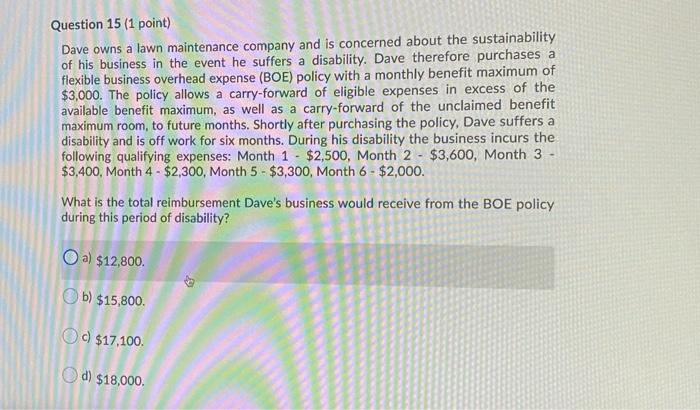

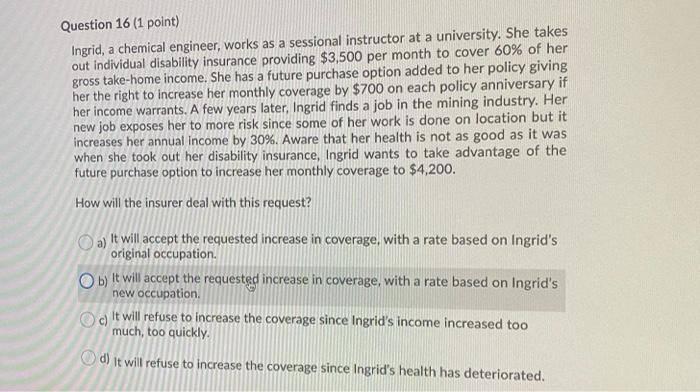

Question 2 (1 point) Alan met with Donna, a new prospect for disability insurance. Donna did not always seem to grasp the importance of the issues raised in completing the non-medical form on the application. When asked if she was a smoker, she answered "no" but did acknowledge that she usually borrows a cigarette or two when she parties, which usually happens about once a month. She felt that the three-month period of disability she incurred a year ago would not be of concern because it was the result of a cycling accident, not a health factor. Although 30 pounds overweight, Donna stated that she is in excellent health and expected that she would easily qualify for coverage, probably at preferred rates. Not wishing to derail the sale, Alan did little to contest Donna's statement, and just recorded her answers on the application. When it came time for Alan to deliver the contract, Donna was unhappy with the revised premium and the restrictions placed on her coverage. She refused delivery, cancelling the policy. Where did Alan go wrong in the interview process? a) He failed to properly manage Donna's expectations regarding the type and extent of coverage that she could realistically expect to receive. b) He should have challenged Donna on her statement that she is in excellent condition and health. c) He failed to get more detailed information from Donna regarding the frequency and nature of her smoking habits. d) Given Donna's admissions, he should have terminated the application process; she was never going to get the standard policy she expected. Question 15 (1 point) Dave owns a lawn maintenance company and is concerned about the sustainability of his business in the event he suffers a disability. Dave therefore purchases a flexible business overhead expense (BOE) policy with a monthly benefit maximum of $3,000. The policy allows a carry-forward of eligible expenses in excess of the available benefit maximum, as well as a carry-forward of the unclaimed benefit maximum room, to future months. Shortly after purchasing the policy, Dave suffers a disability and is off work for six months. During his disability the business incurs the following qualifying expenses: Month 1 - $2,500, Month 2 - $3,600, Month 3 - $3,400, Month 4 - $2,300, Month 5 - $3,300, Month 6 - $2,000. What is the total reimbursement Dave's business would receive from the BOE policy during this period of disability? O a) $12,800 b) $15,800. c) $17,100 d) $18,000. Question 16 (1 point) Ingrid, a chemical engineer, works as a sessional instructor at a university. She takes out individual disability insurance providing $3,500 per month to cover 60% of her gross take-home income. She has a future purchase option added to her policy giving her the right to increase her monthly coverage by $700 on each policy anniversary if her income warrants. A few years later, Ingrid finds a job in the mining industry. Her new job exposes her to more risk since some of her work is done on location but it increases her annual income by 30%. Aware that her health is not as good as it was when she took out her disability insurance, Ingrid wants to take advantage of the future purchase option to increase her monthly coverage to $4,200. How will the insurer deal with this request? a) It will accept the requested increase in coverage, with a rate based on Ingrid's original occupation. Ob) It will accept the requested increase in coverage, with a rate based on Ingrid's new occupation c) It will refuse to increase the coverage since Ingrid's income increased too much, too quickly d) it will refuse to increase the coverage since Ingrid's health has deteriorated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts