Question: Question 2 (1 point) Jackson Co. had the following selected accounts and balances on their unadjusted trial balance. Debit Credit Accounts Receivable 80,000 Allowance for

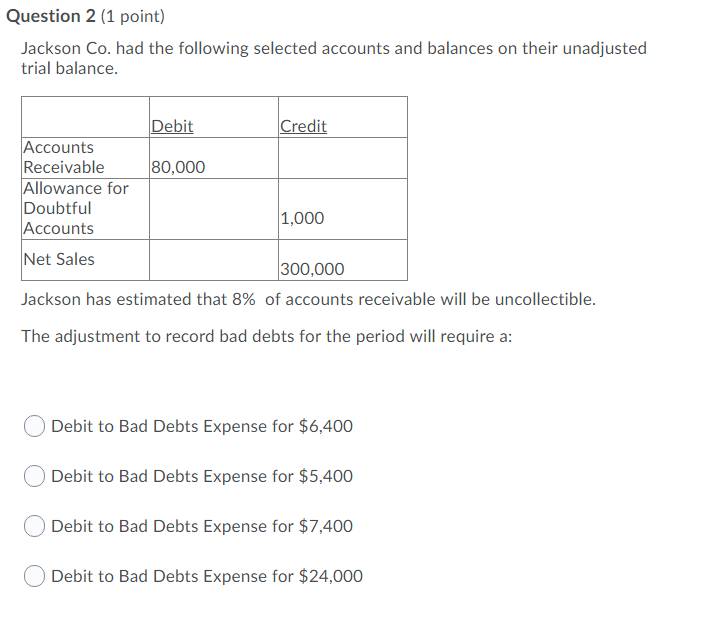

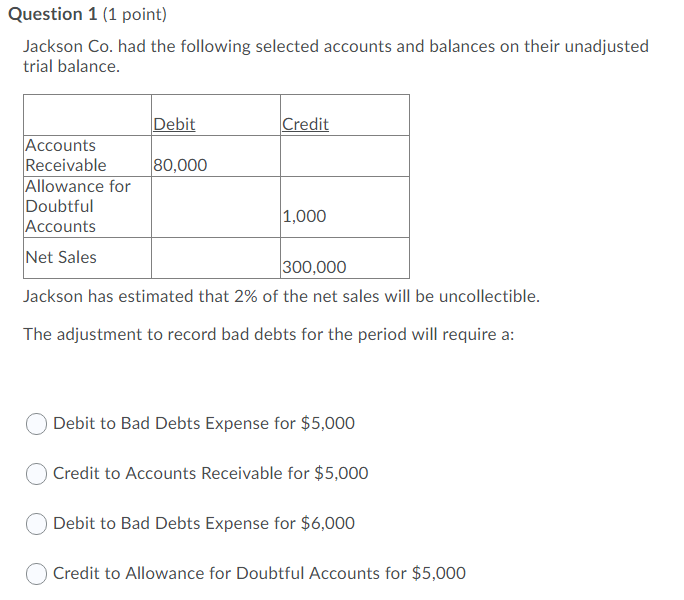

Question 2 (1 point) Jackson Co. had the following selected accounts and balances on their unadjusted trial balance. Debit Credit Accounts Receivable 80,000 Allowance for Doubtful 1,000 Accounts Net Sales 300,000 Jackson has estimated that 8% of accounts receivable will be uncollectible. The adjustment to record bad debts for the period will require a: Debit to Bad Debts Expense for $6,400 Debit to Bad Debts Expense for $5,400 Debit to Bad Debts Expense for $7,400 Debit to Bad Debts Expense for $24,000 Question 1 (1 point) Jackson Co. had the following selected accounts and balances on their unadjusted trial balance. Debit Credit Accounts Receivable 80,000 Allowance for Doubtful 1,000 Accounts Net Sales 300,000 Jackson has estimated that 2% of the net sales will be uncollectible. The adjustment to record bad debts for the period will require a: Debit to Bad Debts Expense for $5,000 Credit to Accounts Receivable for $5,000 Debit to Bad Debts Expense for $6,000 Credit to Allowance for Doubtful Accounts for $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts