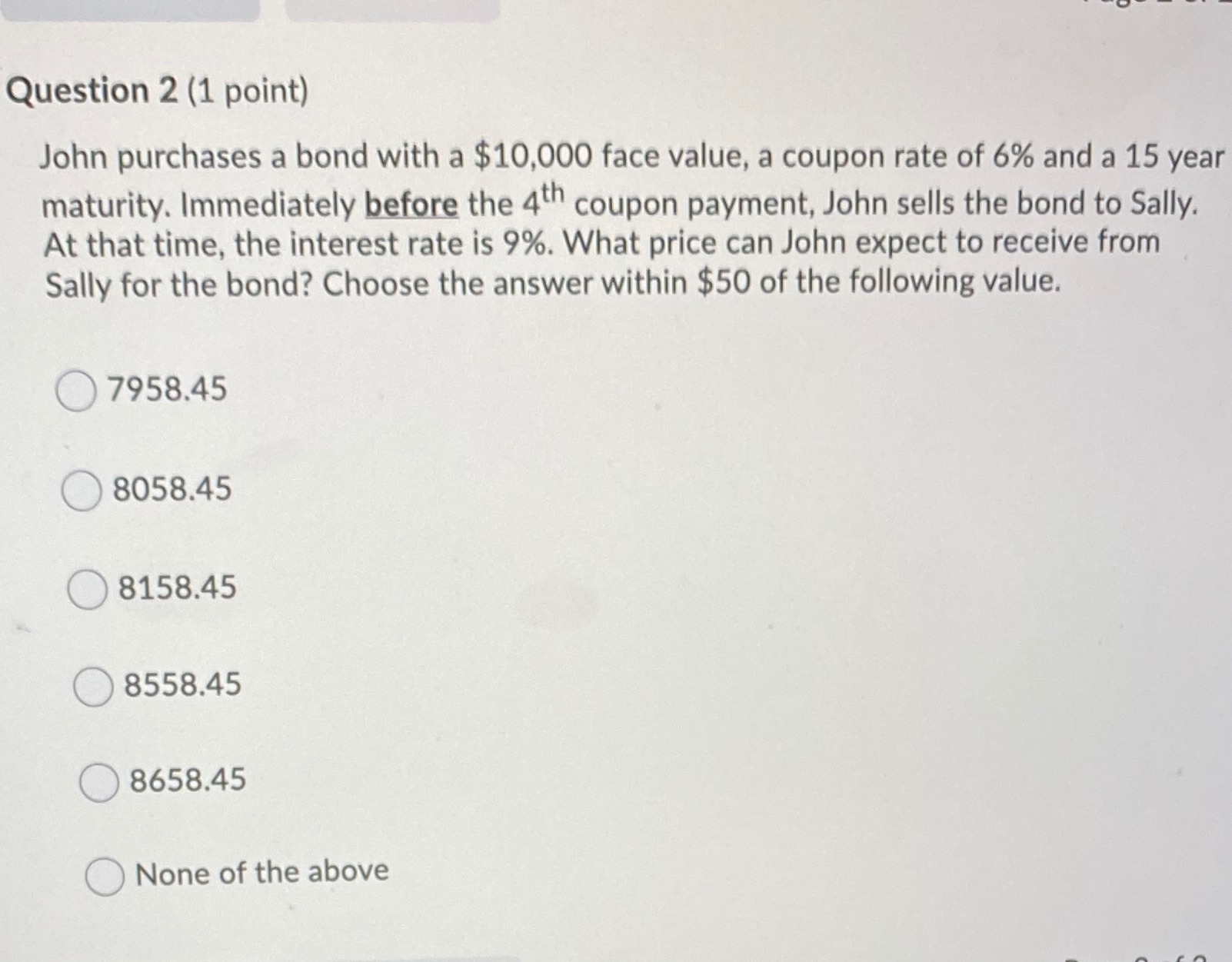

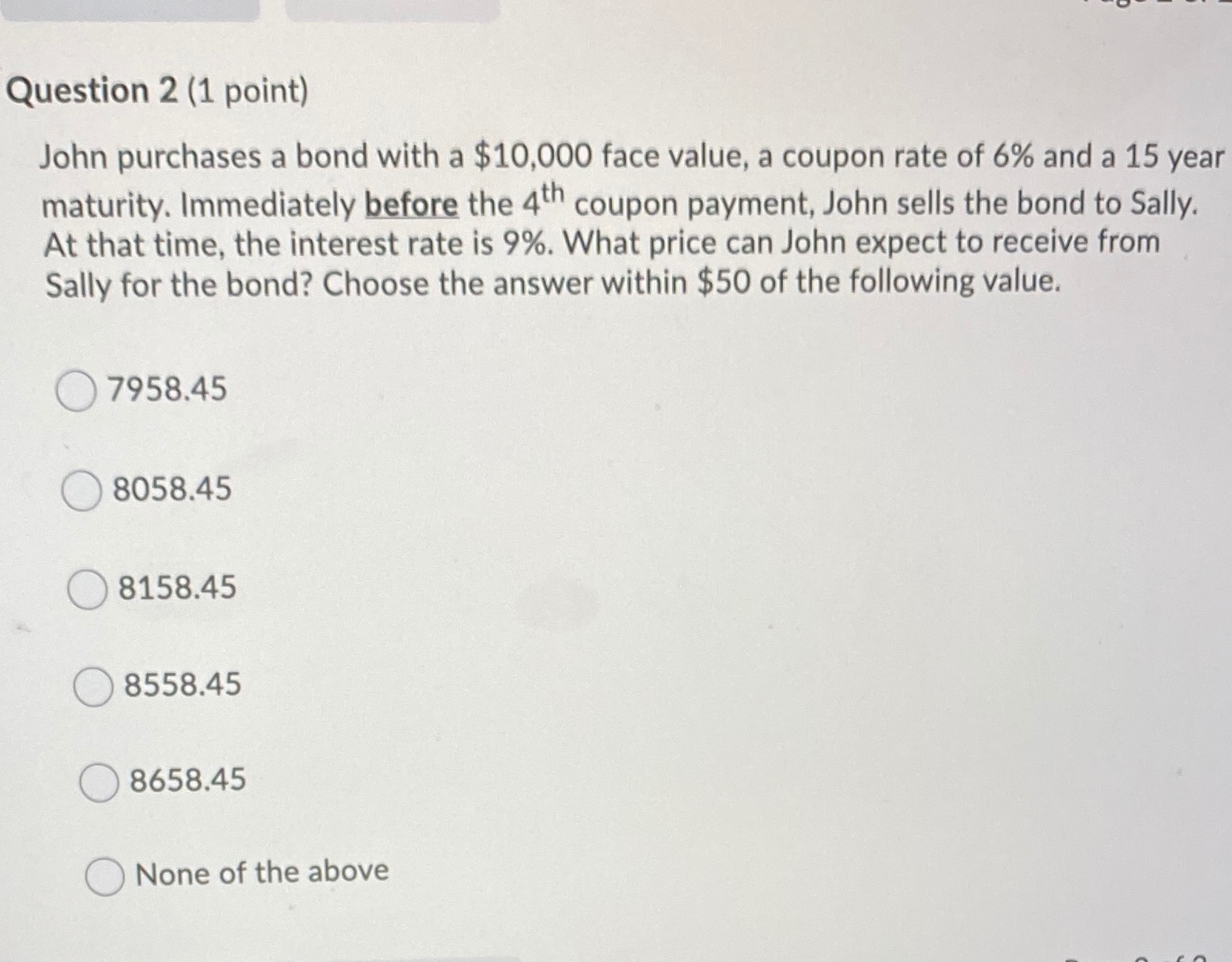

Question: Question 2 (1 point) John purchases a bond with a $10,000 face value, a coupon rate of 6% and a 15 year maturity. Immediately before

Question 2 (1 point) John purchases a bond with a $10,000 face value, a coupon rate of 6% and a 15 year maturity. Immediately before the 4th coupon payment, John sells the bond to Sally. At that time, the interest rate is 9%. What price can John expect to receive from Sally for the bond? Choose the answer within $50 of the following value. 7958.45 8058.45 8158.45 8558.45 8658.45 ONone of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts