Question: Question 2 ( 1 point ) On December 3 1 , 2 0 2 4 , Cindy Ltd . acquired 3 5 % of

Question point

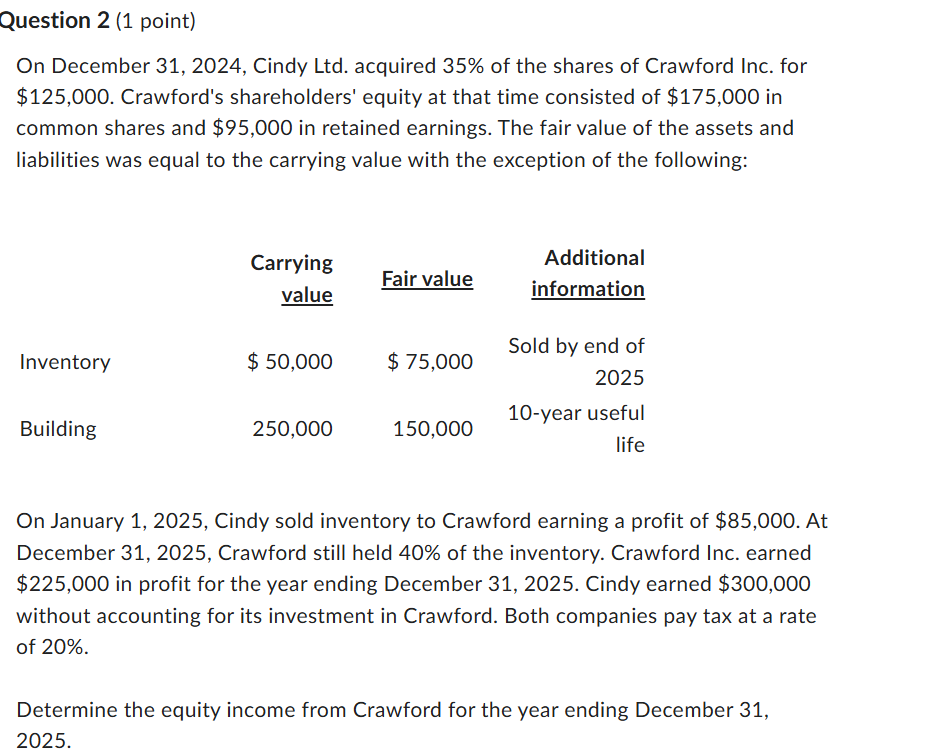

On December Cindy Ltd acquired of the shares of Crawford Inc. for $ Crawford's shareholders' equity at that time consisted of $ in common shares and $ in retained earnings. The fair value of the assets and liabilities was equal to the carrying value with the exception of the following:

On January Cindy sold inventory to Crawford earning a profit of $ At December Crawford still held of the inventory. Crawford Inc. earned $ in profit for the year ending December Cindy earned $ without accounting for its investment in Crawford. Both companies pay tax at a rate of

Determine the equity income from Crawford for the year ending December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock