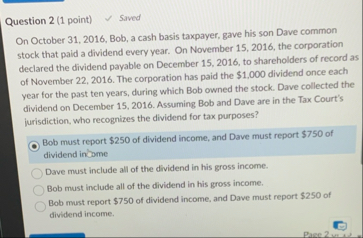

Question: Question 2 ( 1 point ) Saved On October 3 1 , 2 0 1 6 , Bob, a cash basis taxpayer, gave his son

Question point

Saved

On October Bob, a cash basis taxpayer, gave his son Dave common stock that paid a dividend every year. On November the corporation declared the dividend payable on December to shareholders of record as of November The corporation has paid the $ dividend once each year for the past ten years, during whilch Bob owned the stock. Dave collected the dividend on December Assuming Bob and Dave are in the Tax Court's jurisdiction, who recognizes the dividend for tax purposes?

Bob must report $ of dividend income, and Dave must report $ of dividend in ome

Dave must include all of the dividend in his gross income.

Bob must include all of the dividend in his gross income.

Bob must report $ of dividend income, and Dave must report $ of dividend income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock