Question: Question 2 (1 point) Saved You open an account the day your daughter is born. You want to deposit the same amount every year, from

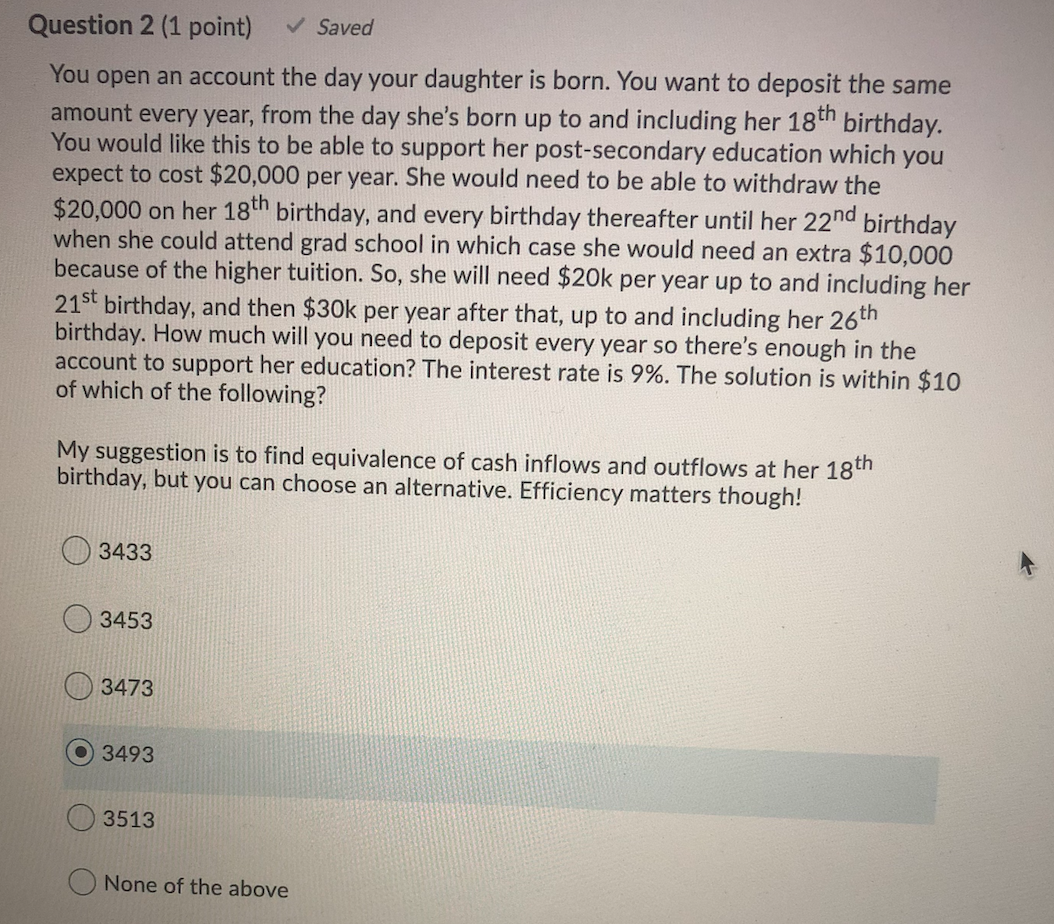

Question 2 (1 point) Saved You open an account the day your daughter is born. You want to deposit the same amount every year, from the day she's born up to and including her 18th birthday. You would like this to be able to support her post-secondary education which you expect to cost $20,000 per year. She would need to be able to withdraw the $20,000 on her 18th birthday, and every birthday thereafter until her 22nd birthday when she could attend grad school in which case she would need an extra $10,000 because of the higher tuition. So, she will need $20k per year up to and including her 21st birthday, and then $30k per year after that, up to and including her 26th birthday. How much will you need to deposit every year so there's enough in the account to support her education? The interest rate is 9%. The solution is within $10 of which of the following? My suggestion is to find equivalence of cash inflows and outflows at her 18th birthday, but you can choose an alternative. Efficiency matters though! 3433 3453 3473 3493 3513 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts