Question: Question 2 (1 point) When assessing weights in the cost of capital, we focus on the book value of equity we review book and market

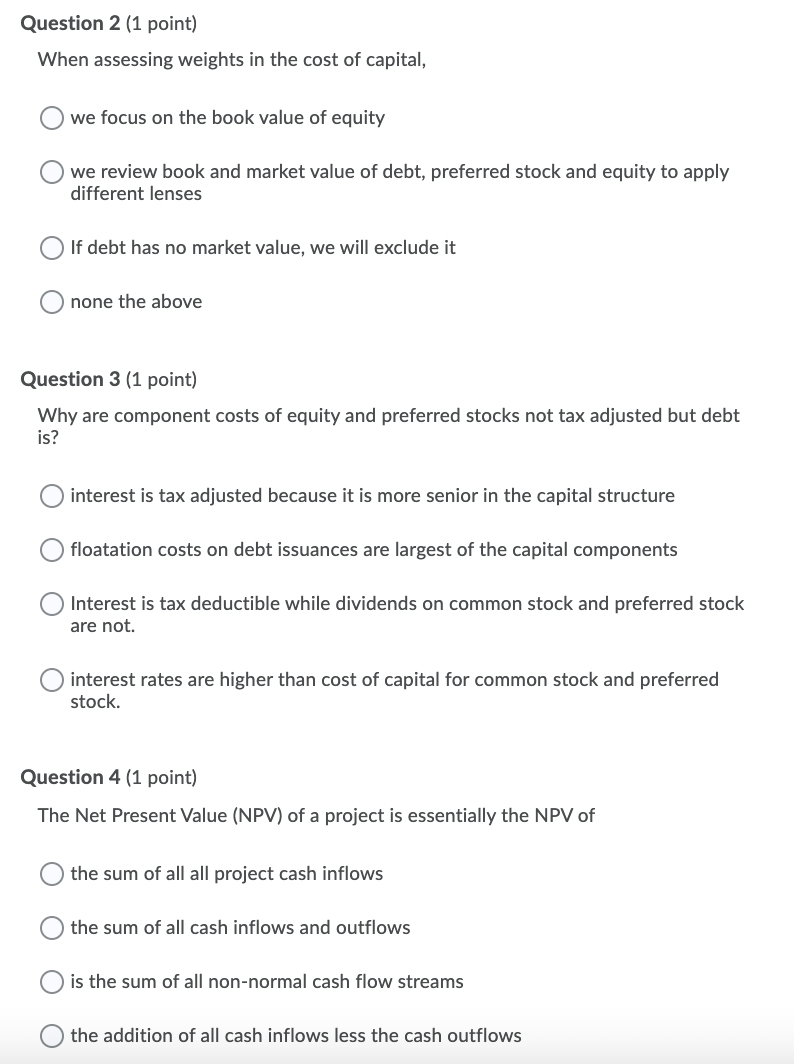

Question 2 (1 point) When assessing weights in the cost of capital, we focus on the book value of equity we review book and market value of debt, preferred stock and equity to apply different lenses If debt has no market value, we will exclude it none the above Question 3 (1 point) Why are component costs of equity and preferred stocks not tax adjusted but debt is? interest is tax adjusted because it is more senior in the capital structure floatation costs on debt issuances are largest of the capital components Interest is tax deductible while dividends on common stock and preferred stock are not. interest rates are higher than cost of capital for common stock and preferred stock. Question 4 (1 point) The Net Present Value (NPV) of a project is essentially the NPV of the sum of all all project cash inflows the sum of all cash inflows and outflows is the sum of all non-normal cash flow streams the addition of all cash inflows less the cash outflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts