Question: Question 2 (1 point) You plan on saving $100 every month for ten years. Select all the true statements. This is an example of uneven

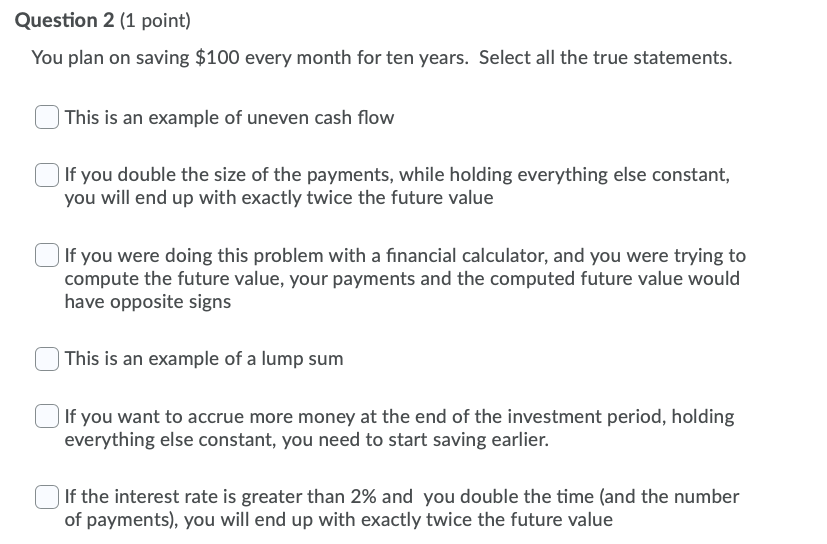

Question 2 (1 point) You plan on saving $100 every month for ten years. Select all the true statements. This is an example of uneven cash flow If you double the size of the payments, while holding everything else constant, you will end up with exactly twice the future value If you were doing this problem with a financial calculator, and you were trying to compute the future value, your payments and the computed future value would have opposite signs This is an example of a lump sum | If you want to accrue more money at the end of the investment period, holding everything else constant, you need to start saving earlier. | If the interest rate is greater than 2% and you double the time (and the number of payments), you will end up with exactly twice the future value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts