Question: Question 2 1 pts A firm has an expected ROE of 8% per year indefinitely. The earnings per share at the end of the previous

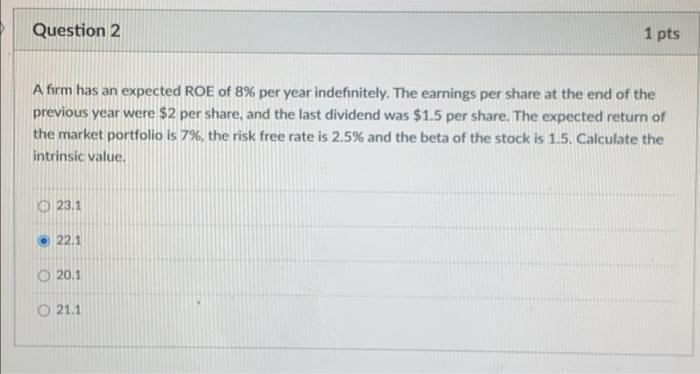

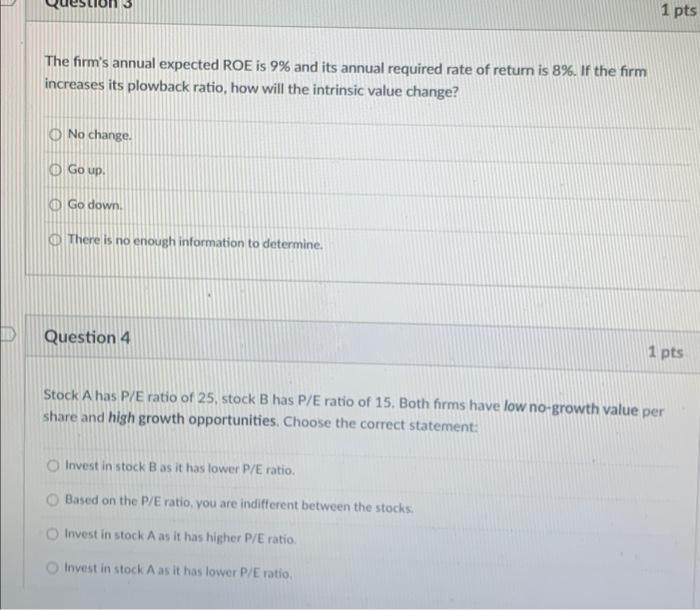

Question 2 1 pts A firm has an expected ROE of 8% per year indefinitely. The earnings per share at the end of the previous year were $2 per share, and the last dividend was $1.5 per share. The expected return of the market portfolio is 7%, the risk free rate is 2.5% and the beta of the stock is 1.5. Calculate the intrinsic value. 23.1 22.1 20.1 21.1 1 pts The firm's annual expected ROE is 9% and its annual required rate of return is 8%. If the firm increases its plowback ratio, how will the intrinsic value change? No change. O Go up Go down There is no enough information to determine, D Question 4 1 pts Stock A has P/E ratio of 25, stock B has P/E ratio of 15. Both firms have low no-growth value per share and high growth opportunities. Choose the correct statement: Invest in stock B as it has lower P/E ratio. Based on the P/E ratio, you are indifferent between the stocks, Invest in stock A as it has higher P/E ratio. Invest in stock A as it has lower P/E ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts