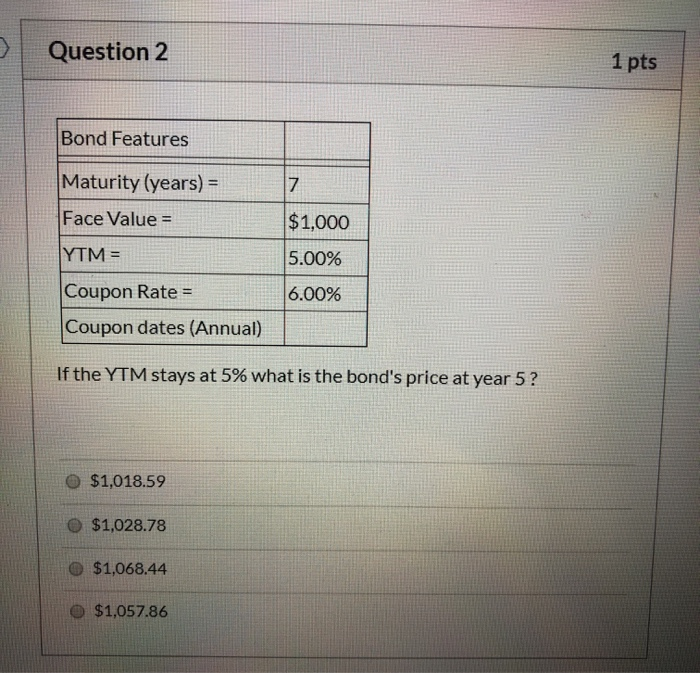

Question: Question 2 1 pts Bond Features Maturity (years) = Face Value = $1,000 5.00% YTM= 6.00% Coupon Rate = Coupon dates (Annual) If the YTM

Question 2 1 pts Bond Features Maturity (years) = Face Value = $1,000 5.00% YTM= 6.00% Coupon Rate = Coupon dates (Annual) If the YTM stays at 5% what is the bond's price at year 5 ? $1,018.59 $1,028.78 $1,068.44 $1,057.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts