Question: Question 2 1 pts OJ Sampson lost a wrongful death lawsuit and was ordered to pay the plantiff $5 million dollars. As a result of

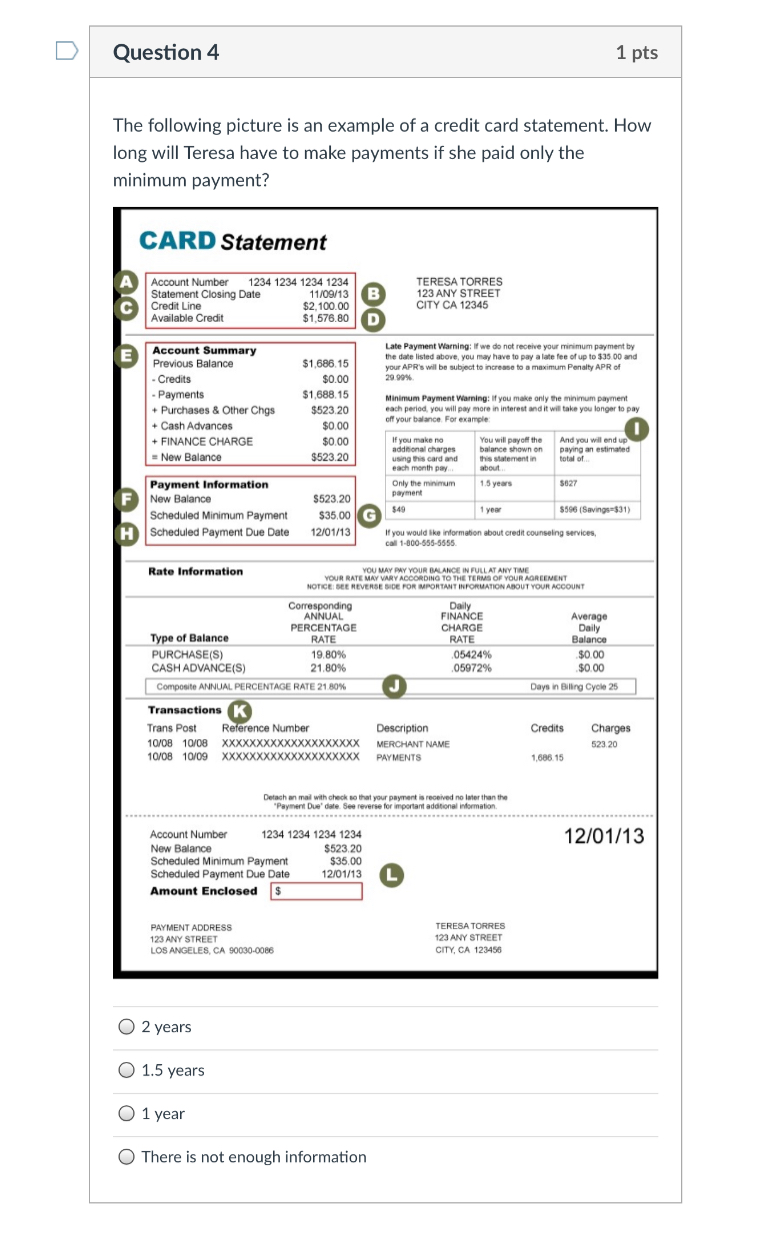

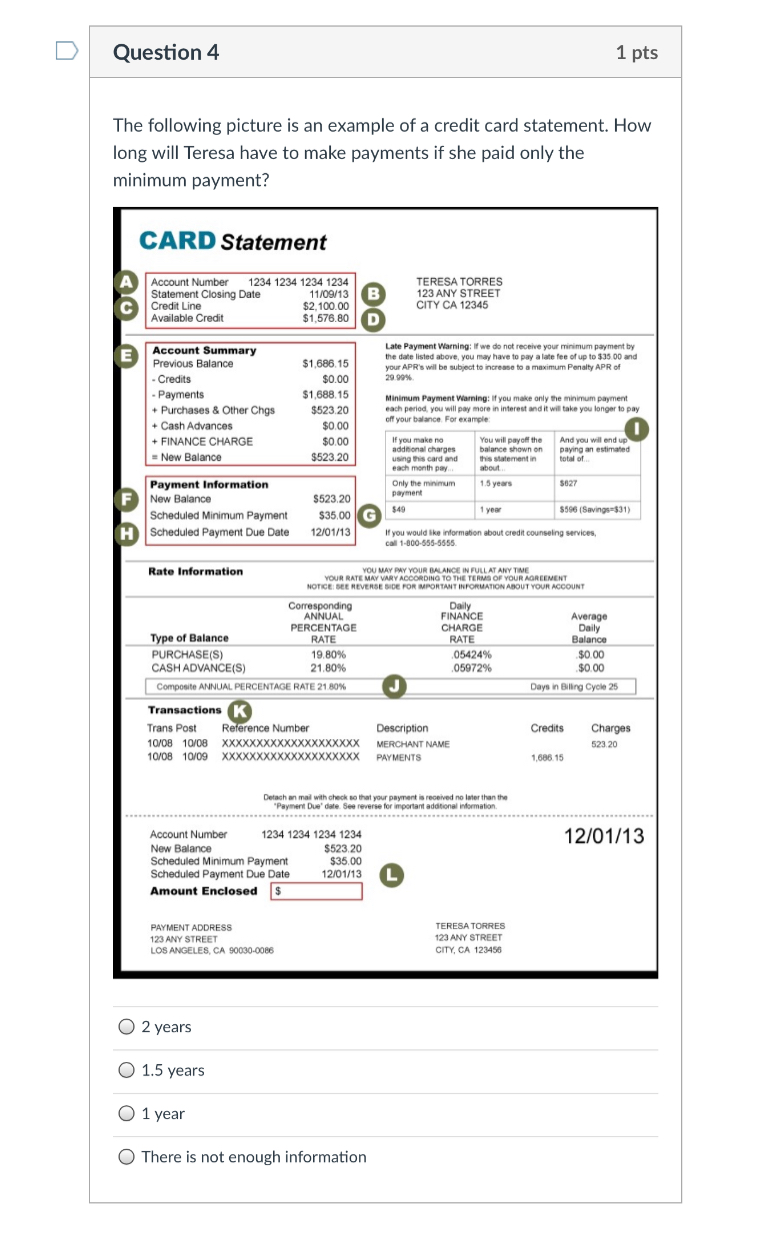

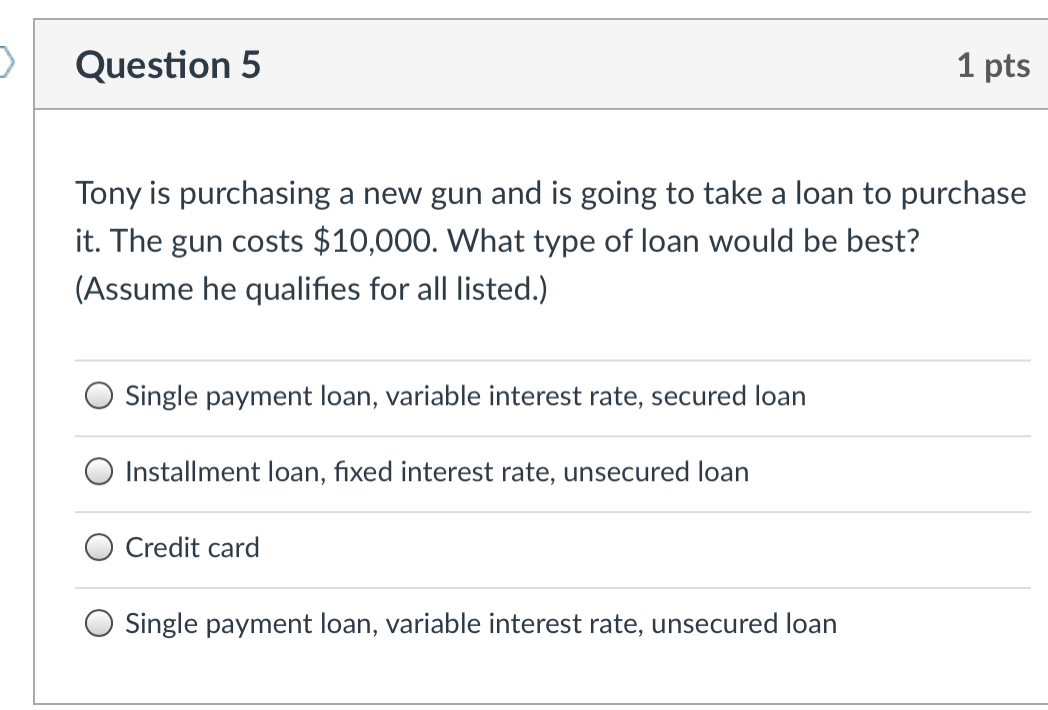

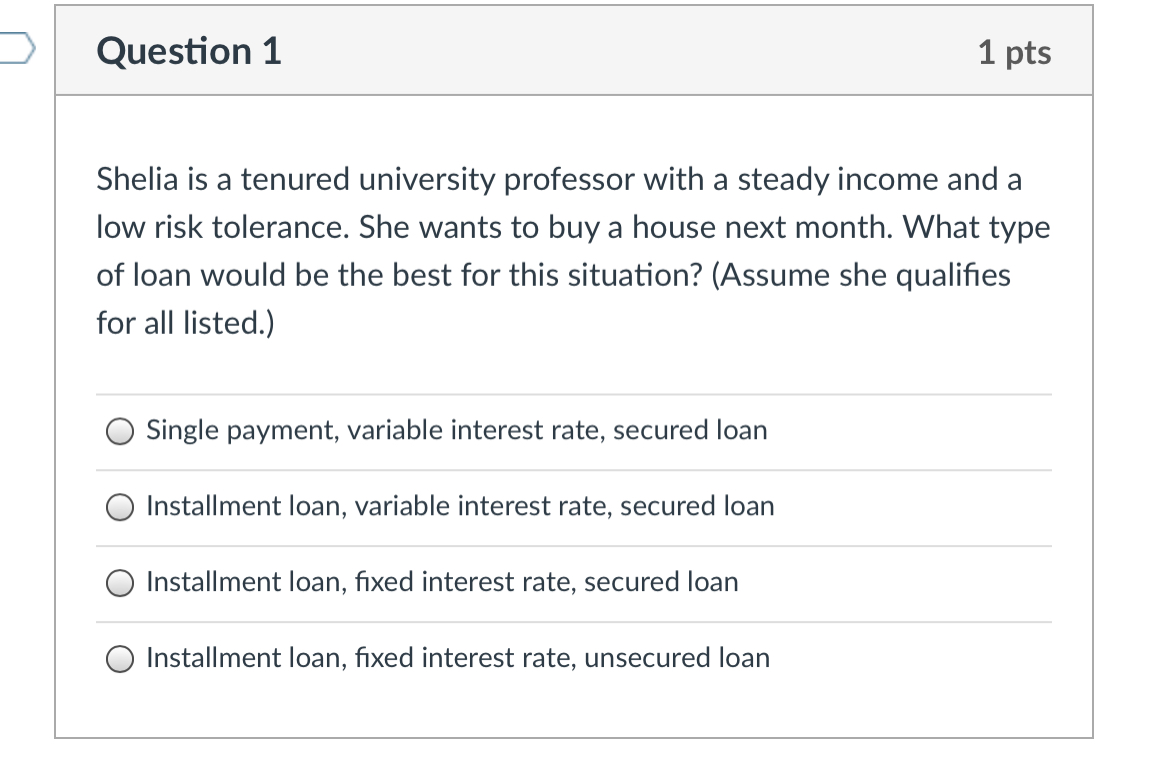

Question 2 1 pts OJ Sampson lost a wrongful death lawsuit and was ordered to pay the plantiff $5 million dollars. As a result of the lawsuit, Mr. Sampson filed for bankruptcy. Which of the following assets are exempt assets in the bankruptcy from his creditors? 1. A Roth IRA worth $900,000. 2. A rollover IRA worth $3.5 million. 3. Football memorabilia worth $1.5 million. 4. A brokerage account worth $2 million. 1 only 1 and 2 3 and 4 2 only Question 3 1 pts On a credit card, a cash advance has the exact same interest rate as a regular purchase. False. True. Question 4 1 pts The following picture is an example of a credit card statement. How long will Teresa have to make payments if she paid only the minimum payment? CARD Statement Account Number 1234 1234 1234 1234 Statement Closing Date 11/09/13 Credit Line $2,100.00 Available Credit $1,576.80 B TERESA TORRES 123 ANY STREET CITY CA 12345 E $1,686.15 $0.00 $ $1,688.15 Late Payment Warning: If we do not receive your minimum payment by the date listed above, you may have to pay a late fee of up to $35.00 and your APR's will be subject to increase to a maximum Penalty APR of 2990% Account Summary Previous Balance - Credits Payments + Purchases & Other Chgs + Cash Advances + FINANCE CHARGE New Balance $523 20 Minimum Payment Warning: If you make only the minimum payment each period, you will pay more in interest and it will take you longer to pay off your balance. For example $0.00 $0.00 $523.20 If you make no additional charges using this card and each month pay Only the minimum payment $49 You will payoff the balance shown on this statement in about 1.5 years And you will end up paying an estimated total of $627 Payment Information F New Balance Scheduled Minimum Payment H Scheduled Payment Due Date $523.20 $35.00 1 year 5596 (Saving531) 12/01/13 If you would like information about credit counseling services, call 1-800-555-5555 Rate Information YOU MAY PWY YOUR BALANCE IN FULL AT ANY TIME YOUR RATE MAY VARY ACCORDING TO THE TERMS OF YOUR AOREEMENT NOTICE SEE REVERSE SIDE FOR IMPORTANT INFORMATION ABOUT YOUR ACCOUNT Average Daily Balance $0.00 $0.00 21.80% Corresponding Daily ANNUAL FINANCE PERCENTAGE CHARGE Type of Balance RATE RATE PURCHASE(S) 19.80% 05424% CASH ADVANCE(S) 05972% Composite ANNUAL PERCENTAGE RATE 21 80% % Transactions K Trans Post Reference Number Description 10/08 10/08 XXXXXX XXXXXXXXXXXXXXXXXXXX XXX MERCHANT NAME 10/08 10/09 XXXXXXX XXXXXXXXXXXXXXXXXXXX xxx PAYMENTS Days in Billing Cycle 25 Credits Charges 523.20 1,686.15 Detachan mal with check so that your payment is received no later than the "Payment Due' date. See reverse for important additional information 12/01/13 Account Number 1234 1234 1234 1234 New Balance $523 20 Scheduled Minimum Payment $35.00 Scheduled Payment Due 12/01/13 Amount Enclosed S PAYMENT ADDRESS 123 ANY STREET LOS ANGELES, CA 90030-0086 TERESA TORRES 123 ANY STREET CITY, CA 123456 O 2 years O 1.5 years O 1 year There is not enough information Question 5 1 pts Tony is purchasing a new gun and is going to take a loan to purchase it. The gun costs $10,000. What type of loan would be best? (Assume he qualifies for all listed.) Single payment loan, variable interest rate, secured loan Installment loan, fixed interest rate, unsecured loan Credit card Single payment loan, variable interest rate, unsecured loan Question 1 1 pts Shelia is a tenured university professor with a steady income and a low risk tolerance. She wants to buy a house next month. What type of loan would be the best for this situation? (Assume she qualifies for all listed.) Single payment, variable interest rate, secured loan Installment loan, variable interest rate, secured loan Installment loan, fixed interest rate, secured loan Installment loan, fixed interest rate, unsecured loan Question 2 1 pts OJ Sampson lost a wrongful death lawsuit and was ordered to pay the plantiff $5 million dollars. As a result of the lawsuit, Mr. Sampson filed for bankruptcy. Which of the following assets are exempt assets in the bankruptcy from his creditors? 1. A Roth IRA worth $900,000. 2. A rollover IRA worth $3.5 million. 3. Football memorabilia worth $1.5 million. 4. A brokerage account worth $2 million. 1 only 1 and 2 3 and 4 2 only Question 3 1 pts On a credit card, a cash advance has the exact same interest rate as a regular purchase. False. True. Question 4 1 pts The following picture is an example of a credit card statement. How long will Teresa have to make payments if she paid only the minimum payment? CARD Statement Account Number 1234 1234 1234 1234 Statement Closing Date 11/09/13 Credit Line $2,100.00 Available Credit $1,576.80 B TERESA TORRES 123 ANY STREET CITY CA 12345 E $1,686.15 $0.00 $ $1,688.15 Late Payment Warning: If we do not receive your minimum payment by the date listed above, you may have to pay a late fee of up to $35.00 and your APR's will be subject to increase to a maximum Penalty APR of 2990% Account Summary Previous Balance - Credits Payments + Purchases & Other Chgs + Cash Advances + FINANCE CHARGE New Balance $523 20 Minimum Payment Warning: If you make only the minimum payment each period, you will pay more in interest and it will take you longer to pay off your balance. For example $0.00 $0.00 $523.20 If you make no additional charges using this card and each month pay Only the minimum payment $49 You will payoff the balance shown on this statement in about 1.5 years And you will end up paying an estimated total of $627 Payment Information F New Balance Scheduled Minimum Payment H Scheduled Payment Due Date $523.20 $35.00 1 year 5596 (Saving531) 12/01/13 If you would like information about credit counseling services, call 1-800-555-5555 Rate Information YOU MAY PWY YOUR BALANCE IN FULL AT ANY TIME YOUR RATE MAY VARY ACCORDING TO THE TERMS OF YOUR AOREEMENT NOTICE SEE REVERSE SIDE FOR IMPORTANT INFORMATION ABOUT YOUR ACCOUNT Average Daily Balance $0.00 $0.00 21.80% Corresponding Daily ANNUAL FINANCE PERCENTAGE CHARGE Type of Balance RATE RATE PURCHASE(S) 19.80% 05424% CASH ADVANCE(S) 05972% Composite ANNUAL PERCENTAGE RATE 21 80% % Transactions K Trans Post Reference Number Description 10/08 10/08 XXXXXX XXXXXXXXXXXXXXXXXXXX XXX MERCHANT NAME 10/08 10/09 XXXXXXX XXXXXXXXXXXXXXXXXXXX xxx PAYMENTS Days in Billing Cycle 25 Credits Charges 523.20 1,686.15 Detachan mal with check so that your payment is received no later than the "Payment Due' date. See reverse for important additional information 12/01/13 Account Number 1234 1234 1234 1234 New Balance $523 20 Scheduled Minimum Payment $35.00 Scheduled Payment Due 12/01/13 Amount Enclosed S PAYMENT ADDRESS 123 ANY STREET LOS ANGELES, CA 90030-0086 TERESA TORRES 123 ANY STREET CITY, CA 123456 O 2 years O 1.5 years O 1 year There is not enough information Question 5 1 pts Tony is purchasing a new gun and is going to take a loan to purchase it. The gun costs $10,000. What type of loan would be best? (Assume he qualifies for all listed.) Single payment loan, variable interest rate, secured loan Installment loan, fixed interest rate, unsecured loan Credit card Single payment loan, variable interest rate, unsecured loan Question 1 1 pts Shelia is a tenured university professor with a steady income and a low risk tolerance. She wants to buy a house next month. What type of loan would be the best for this situation? (Assume she qualifies for all listed.) Single payment, variable interest rate, secured loan Installment loan, variable interest rate, secured loan Installment loan, fixed interest rate, secured loan Installment loan, fixed interest rate, unsecured loan