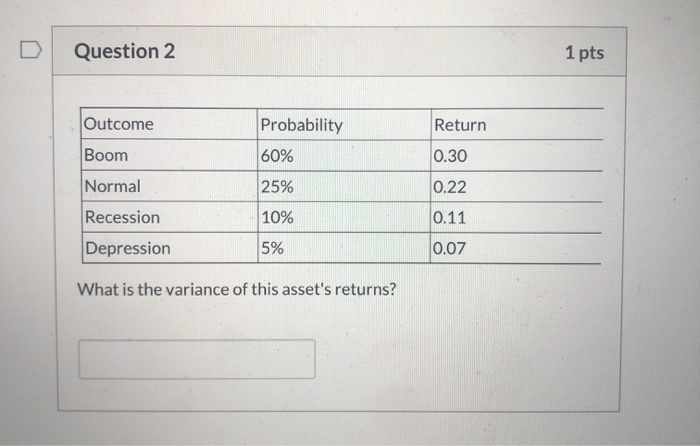

Question: Question 2 1 pts Outcome Return Probability 60% Boom 0.30 Normal 25% 0.22 Recession 10% 0.11 Depression 5% 0.07 What is the variance of this

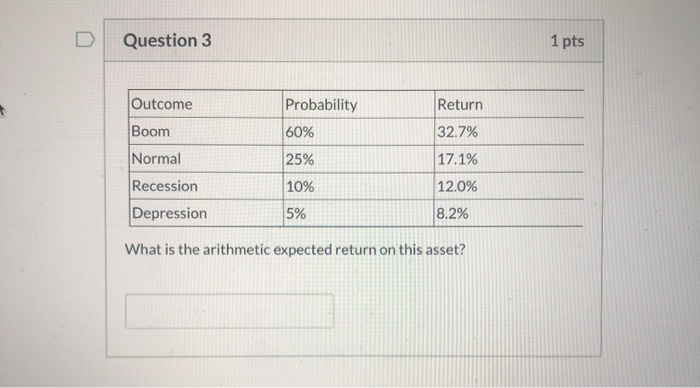

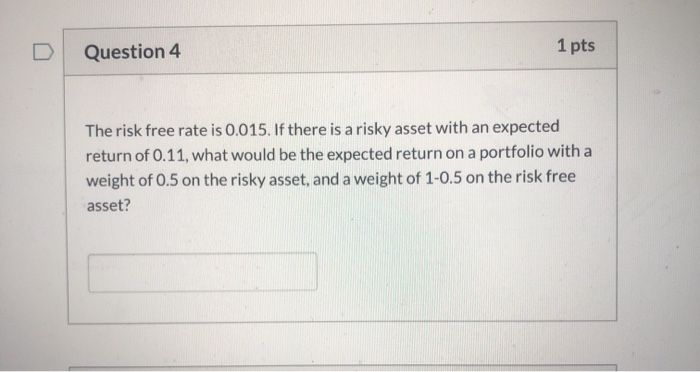

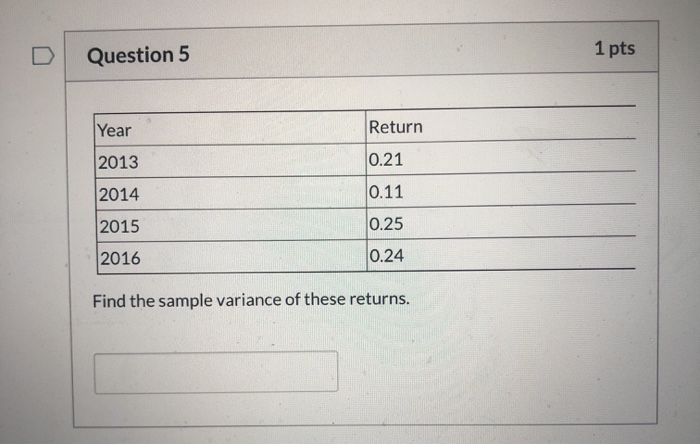

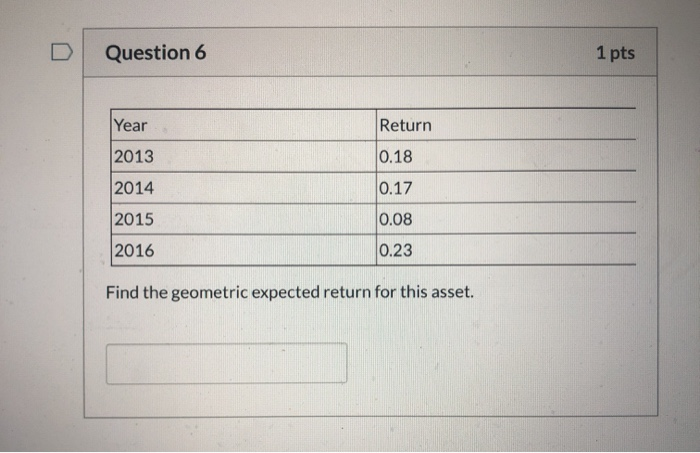

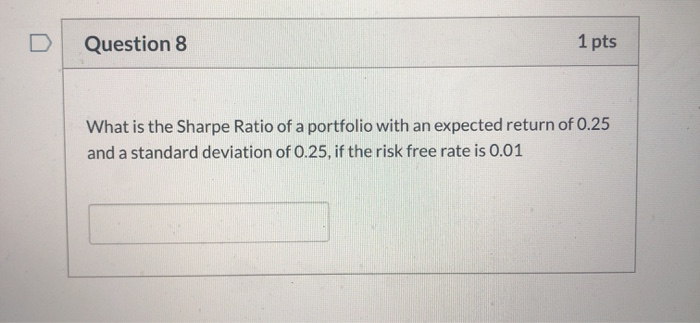

Question 2 1 pts Outcome Return Probability 60% Boom 0.30 Normal 25% 0.22 Recession 10% 0.11 Depression 5% 0.07 What is the variance of this asset's returns? Question 3 1 pts Outcome Probability Return Boom 60% 32.7% Normal 25% 17.1% 10% 12.0% Recession Depression 5% 8.2% What is the arithmetic expected return on this asset? Question 4 1 pts The risk free rate is 0.015. If there is a risky asset with an expected return of 0.11, what would be the expected return on a portfolio with a weight of 0.5 on the risky asset, and a weight of 1-0.5 on the risk free asset? Question 5 1 pts Year Return 2013 0.21 2014 0.11 2015 0.25 2016 0.24 Find the sample variance of these returns. Question 6 1 pts Year Return 2013 0.18 2014 0.17 2015 0.08 2016 0.23 Find the geometric expected return for this asset. Question 8 1 pts What is the Sharpe Ratio of a portfolio with an expected return of 0.25 and a standard deviation of 0.25, if the risk free rate is 0.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts