Question: Question 2 1 pts The table below lists the prices and Greek measures of two European call options on stock X. Price Delta Gamma Vega

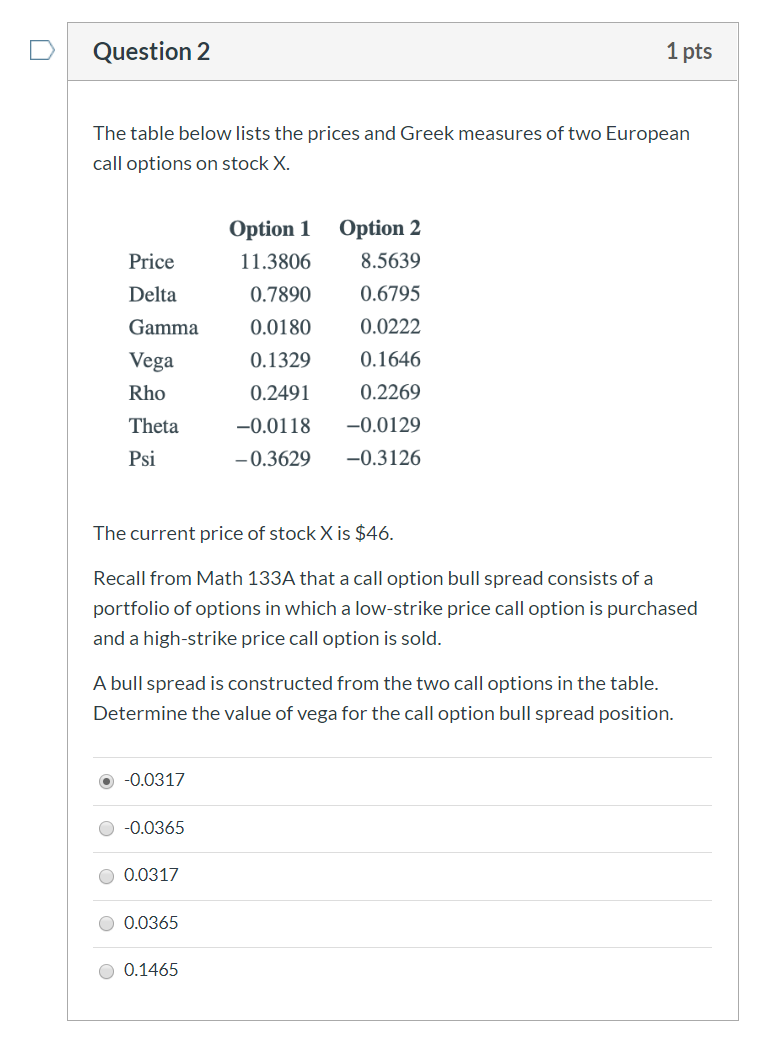

Question 2 1 pts The table below lists the prices and Greek measures of two European call options on stock X. Price Delta Gamma Vega Rho Option 1 11.3806 0.7890 0.0180 0.1329 0.2491 -0.0118 -0.3629 Option 2 8.5639 0.6795 0.0222 0.1646 0.2269 -0.0129 -0.3126 Theta Psi The current price of stock X is $46. Recall from Math 133A that a call option bull spread consists of a portfolio of options in which a low-strike price call option is purchased and a high-strike price call option is sold. A bull spread is constructed from the two call options in the table. Determine the value of vega for the call option bull spread position. -0.0317 -0.0365 O 0.0317 0.0365 O 0.1465

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts