Question: Question 2 1 pts Use the bond term's below to answer the question Maturity 6 years Coupon Rate 4% Face value $1,000 Annual Coupons YTM

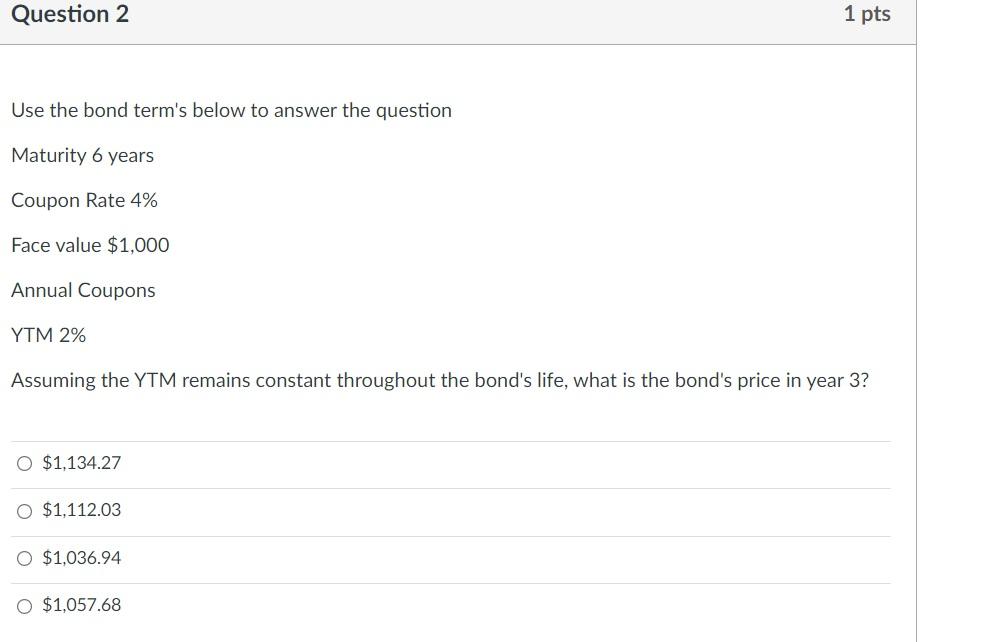

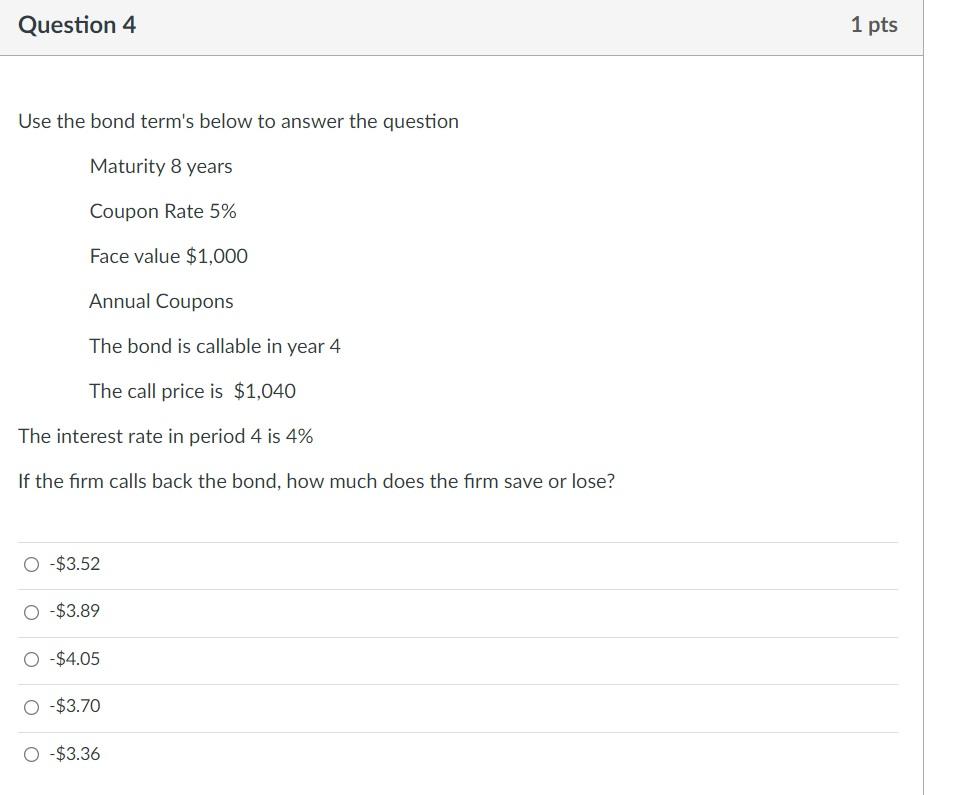

Question 2 1 pts Use the bond term's below to answer the question Maturity 6 years Coupon Rate 4% Face value $1,000 Annual Coupons YTM 2% Assuming the YTM remains constant throughout the bond's life, what is the bond's price in year 3? O $1,134.27 O $1,112.03 O $1,036.94 O $1,057.68 Question 4 1 pts Use the bond term's below to answer the question Maturity 8 years Coupon Rate 5% Face value $1,000 Annual Coupons The bond is callable in year 4 The call price is $1,040 The interest rate in period 4 is 4% If the firm calls back the bond, how much does the firm save or lose? -$3.52 $3.89 $4.05 - $3.70 O $3.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts